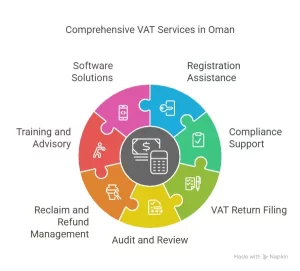

VAT services in Oman refer to the range of professional, advisory, and technological solutions provided to businesses to help them comply with the country’s VAT regulations. Introduced as part of Oman’s economic diversification efforts, VAT requires businesses to manage tax obligations effectively, and VAT services bridge the gap between regulatory requirements and operational efficiency. These services are typically offered by accounting firms, tax consultants, and software providers. They include:

- Registration Assistance: Guiding businesses through the online registration process with the Oman Tax Authority (OTA), ensuring they meet mandatory or voluntary thresholds.

- Compliance Support: Helping businesses calculate, collect, and remit VAT, file returns accurately, and maintain records for the required 10 years (15 years for real estate).

- VAT Return Filing: Preparing and submitting quarterly VAT returns, due within 30 days after each tax period ends.

- Audit and Review: Conducting internal VAT audits to ensure compliance and identify errors before official OTA assessments.

- Reclaim and Refund Management: Assisting with reclaiming input VAT on business expenses or securing refunds, especially for zero-rated supplies.

- Training and Advisory: Educating staff on VAT rules and advising on tax planning, such as VAT grouping or handling cross-border transactions.

- Software Solutions: Providing tools to automate VAT calculations, invoicing, and reporting, reducing manual workload.

For example, a construction company in Muscat might use VAT services to register with the OTA, file returns for its 5% taxable supplies, and reclaim VAT on materials purchased, ensuring compliance while optimizing cash flow.

Below is a detailed explanation of each topic related to VAT services in Oman, tailored to provide a comprehensive understanding based on the context of Value-Added Tax (VAT) as it applies in Oman.

VAT Services in Oman

VAT services in Oman refer to the range of professional, advisory, and technological solutions provided to businesses to help them comply with the country’s VAT regulations. Introduced as part of Oman’s economic diversification efforts, VAT requires businesses to manage tax obligations effectively, and VAT services bridge the gap between regulatory requirements and operational efficiency. These services are typically offered by accounting firms, tax consultants, and software providers. They include:

- Registration Assistance: Guiding businesses through the online registration process with the Oman Tax Authority (OTA), ensuring they meet mandatory or voluntary thresholds.

- Compliance Support: Helping businesses calculate, collect, and remit VAT, file returns accurately, and maintain records for the required 10 years (15 years for real estate).

- VAT Return Filing: Preparing and submitting quarterly VAT returns, due within 30 days after each tax period ends.

- Audit and Review: Conducting internal VAT audits to ensure compliance and identify errors before official OTA assessments.

- Reclaim and Refund Management: Assisting with reclaiming input VAT on business expenses or securing refunds, especially for zero-rated supplies.

- Training and Advisory: Educating staff on VAT rules and advising on tax planning, such as VAT grouping or handling cross-border transactions.

- Software Solutions: Providing tools to automate VAT calculations, invoicing, and reporting, reducing manual workload.

For example, a construction company in Muscat might use VAT services to register with the OTA, file returns for its 5% taxable supplies, and reclaim VAT on materials purchased, ensuring compliance while optimizing cash flow.

What is VAT in Oman?

VAT, or Value-Added Tax, in Oman is an indirect consumption tax levied on the supply of goods and services at each stage of the production and distribution process. It’s designed to tax the “value added” at every step, from raw materials to the final consumer, who ultimately bears the cost. Introduced to diversify revenue away from oil dependency, VAT in Oman aligns with the Gulf Cooperation Council (GCC) Unified VAT Framework.

- Mechanism: Businesses charge VAT on their sales (output tax) and deduct VAT paid on purchases (input tax), remitting the net amount to the OTA. For instance, a retailer buying goods for 100 OMR + 5 OMR VAT and selling them for 150 OMR + 7.5 OMR VAT would remit 2.5 OMR (7.5 – 5) to the government.

- Scope: It applies to most goods and services bought, sold, or imported into Oman, unless specifically zero-rated or exempt.

- Purpose: VAT generates revenue for public services and infrastructure, reducing reliance on hydrocarbons. It’s projected to contribute about 1.5% to Oman’s GDP annually.

Think of VAT as a chain: a farmer sells wheat to a baker, adding VAT; the baker sells bread to a store, adding more VAT; the store sells to you, and you pay the total VAT accumulated—businesses along the way just pass it on.

VAT Implementation in Oman

VAT was implemented in Oman on April 16, 2021, following Royal Decree No. 121/2020, issued on October 12, 2020, and published in the Official Gazette on October 18, 2020. Oman became the fourth GCC country to adopt VAT, after the UAE, Saudi Arabia, and Bahrain, as part of a regional agreement signed in 2016.

- Timeline: The law took effect 180 days after publication, with registration opening in January 2021. Businesses had to prepare systems and processes by April.

- Legislation: The VAT Law sets general principles, while the Executive Regulations (issued March 2021 via Tax Authority Decision No. 53/2021) detail specifics like rates, exemptions, and compliance.

- Preparation: Businesses were urged to form steering committees, train staff, and update IT systems for invoicing and reporting. The OTA provided online registration and industry-specific guides (e.g., for healthcare, real estate).

- Economic Context: Implemented amid a post-COVID economic downturn and low oil prices, VAT aimed to bolster government revenue without overburdening essentials, hence the exemptions and zero-ratings.

The rollout was strategic: Oman set a low 5% rate (compared to 15% in Saudi Arabia) and cushioned the impact by zero-rating basics like food and exempting sectors like education, balancing revenue goals with social welfare.

VAT Rates in Oman

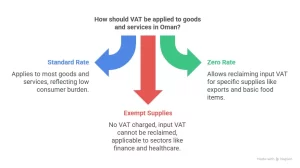

Oman applies a single standard VAT rate, with provisions for zero-rated and exempt supplies:

- Standard Rate: 5%: This applies to most goods and services supplied in Oman, from manufacturing to retail. For example, a 100 OMR laptop incurs 5 OMR VAT. At 5%, it’s one of the lowest globally, reflecting Oman’s intent to minimize consumer burden.

- Zero Rate: 0%: Certain supplies are taxable but charged at 0%, allowing businesses to reclaim input VAT. Examples include exports and basic food items (see below).

- Exempt Supplies: No VAT is charged, and input VAT cannot be reclaimed. This covers sectors like financial services and healthcare (see below).

The 5% rate is uniform unless an exception applies, determined by the OTA’s lists and regulations. For instance, a car sold locally carries 5% VAT, but if exported, it’s 0%, incentivizing trade while taxing domestic consumption.

What are the Zero-rated VAT Products in Oman?

Zero-rated supplies in Oman are taxable at 0%, meaning no VAT is charged on the sale, but businesses can reclaim VAT paid on related purchases. This supports key sectors and exports. Per the VAT Law and Ministerial Decree 2/2021, zero-rated products and services include:

- Basic Food Items: 94 items like milk, meat, fish, poultry, fresh eggs, vegetables, fruits, coffee, tea, olive oil, sugar, bread, bottled water, and salt.

- Medicines and Medical Equipment: As specified by the OTA and coordinated with health authorities.

- Investment Metals: Gold, silver, and platinum used for investment purposes.

- Exports: Goods and services supplied outside Oman or the GCC, including re-exports of temporarily imported goods.

- International Transport: Air, sea, or land transport of goods/passengers across borders, plus related services.

- Oil and Gas: Crude oil, oil derivatives, and natural gas.

- Rescue Vehicles: Aircraft or vessels for rescue/assistance operations.

- Commercial Transport: Supply of transport means (e.g., buses, ships) for commercial use and related services.

For example, a company exporting dates pays no VAT on the sale but reclaims VAT on packaging costs, boosting competitiveness abroad.

What are the Exempted Categories in VAT Oman?

Exempt supplies in Oman are not subject to VAT, and businesses cannot reclaim input VAT on related expenses. These exemptions protect essential services and reduce administrative burdens. Categories include:

- Financial Services: Fee-based services (e.g., loans, insurance) are often exempt, though specifics depend on regulations (e.g., life insurance may be exempt, but not all insurance).

- Healthcare: Preventive and curative services, plus related goods (excluding medicines, which are zero-rated).

- Education: Services and related goods (e.g., textbooks) provided by educational institutions.

- Residential Property: Renting or reselling residential buildings (commercial properties are taxable at 5%).

- Local Transport: Passenger transport within Oman (e.g., buses, taxis).

- Bare Land: Sale of undeveloped land.

- Charities: Supplies by non-profit organizations, subject to OTA conditions.

- Imports for Specific Use: Goods for diplomatic bodies, military forces, or personal effects of first-time residents/returning citizens, if reciprocal exemptions apply.

For instance, a school doesn’t charge VAT on tuition and can’t reclaim VAT on desks it buys, keeping costs lower for students but absorbing some tax burden.

Types of VAT Services in Oman

VAT services in Oman vary based on business needs and complexity. Common types include:

- VAT Registration Services: Assisting with mandatory (OMR 38,500 annual turnover) or voluntary (OMR 19,250) registration via the OTA portal.

- Compliance and Filing Services: Preparing and submitting quarterly VAT returns, ensuring accurate tax calculations and timely payments.

- Advisory Services: Offering strategic advice on VAT planning, exemptions, zero-rating eligibility, and cross-border rules (e.g., reverse charge for imports).

- Audit Services: Reviewing VAT processes to ensure compliance and avoid penalties (OTA can assess taxes up to 5 years back, or 10 if unregistered).

- Refund Services: Managing input VAT reclaims or refunds, especially for exporters or zero-rated suppliers.

- Training Services: Educating staff on VAT rules, invoicing, and record-keeping (e.g., retaining tax invoices in Arabic if requested).

- Technology Solutions: Providing software for automated VAT tracking, invoicing, and reporting, tailored to Oman’s 5% rate and exceptions.

- Specialized Consulting: Handling niche issues like VAT grouping (for corporate groups) or special zone transactions (e.g., free zones with zero-rating).

A retailer might use compliance and software services to manage daily sales, while an exporter might prioritize refund and advisory services to maximize input tax recovery.

Technology-Driven Solutions

Xact Auditing leverages OTA-compliant software to streamline VAT processes. Their tools automate invoicing, tax calculations, and reporting, minimizing errors and saving time. For an e-commerce business selling across GCC borders, this tech ensures the right VAT rate (5% domestically, 0% for exports) is applied and records are audit-ready. This is especially valuable in Oman, where digital compliance is encouraged, and penalties for mistakes can sting.

Tailored Industry-Specific Advice

Unlike generic providers, Xact customizes its services to your sector. Whether you’re in construction (5% taxable supplies), healthcare (exempt), or exports (zero-rated), they assess your specific VAT exposure. They also advise on complex scenarios—like VAT grouping for corporate entities or reverse charge mechanisms for imported services—ensuring you stay compliant while optimizing tax outcomes.

Cost-Effective and Accessible

Xact Auditing offers competitive pricing, appealing to Oman’s small-to-medium enterprise (SME) market. You get high-caliber expertise without the hefty fees of larger firms. For a startup or mid-sized business, this balance of quality and affordability can ease the financial strain of VAT compliance—registration, filing, audits, and beyond.

Proven Regional Experience

With a strong presence in the GCC, including the UAE since VAT’s 2018 rollout there, Xact Auditing has a head start on Oman’s 2021 implementation. Their regional track record means they’ve tackled every VAT challenge—from special economic zones to cross-border rules—making them a reliable partner. Businesses in Oman benefit from this experience, knowing Xact has refined its approach over years.

Responsive Client Support

Xact emphasizes quick, responsive service. Whether you’re facing an OTA notice, a tight filing deadline, or a refund query, their team acts fast. This agility is critical in Oman, where non-compliance can trigger penalties or audits, and businesses need a partner who keeps them ahead of the curve.

Final words..

Choosing Xact Auditing for VAT services in Oman means partnering with a firm that combines local expertise, full-spectrum support, cutting-edge tech, and industry-specific guidance—all at a reasonable cost. Their proven GCC experience and client-first approach make them a standout option for businesses aiming to master VAT compliance without distraction. Whether you’re a retailer, exporter, or service provider, Xact can help you navigate Oman’s 5% VAT system efficiently and confidently. If you have specific needs—like software preferences or sector concerns—let me know, and I can refine this further!