VAT registration is the process by which a business enrolls with a tax authority—in Oman’s case, the Oman Tax Authority (OTA)—to become a VAT-registered entity. Once registered, the business is responsible for charging VAT on taxable supplies (output tax), reclaiming VAT paid on business expenses (input tax), and remitting the net amount to the government. In Oman, VAT was introduced on April 16, 2021, under Royal Decree No. 121/2020, with a standard rate of 5%. Registration assigns a unique Tax Identification Number (TIN) and integrates the business into the VAT system, ensuring compliance with legal obligations and enabling participation in tax recovery mechanisms.

For example, a manufacturing firm in Sohar producing goods worth OMR 50,000 annually would register to charge 5% VAT (OMR 2,500) on sales, reclaim VAT on raw materials, and file quarterly returns. Registration is the gateway to this process, aligning businesses with Oman’s goal to diversify revenue beyond oil.

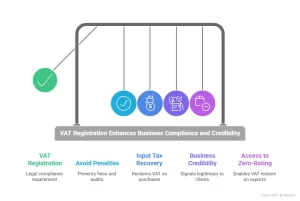

Why VAT Registration is Important?

VAT registration is critical for several reasons, impacting compliance, finances, and operations:

- Legal Compliance: In Oman, businesses exceeding OMR 38,500 in annual taxable turnover must register within 30 days of crossing this threshold, as mandated by the VAT Law. Failure to do so risks penalties, including fines up to OMR 5,000 or tax assessments going back 10 years if unregistered.

- Input Tax Recovery: Registration allows businesses to reclaim VAT paid on purchases (e.g., equipment, services), reducing costs. Without it, this tax becomes an expense. A retailer, for instance, could recover OMR 500 in VAT on inventory, improving cash flow.

- Business Credibility: Being VAT-registered signals legitimacy to clients and suppliers, especially in B2B transactions where buyers prefer dealing with registered entities to claim their own input tax.

- Avoiding Penalties: Late or non-registration triggers OTA audits, interest on unpaid VAT (1% per month), and reputational damage. Registration ensures you stay ahead of enforcement.

- Access to Zero-Rating: For exporters or suppliers of zero-rated goods (e.g., food, medicines), registration is essential to reclaim input VAT, even though no VAT is charged on sales.

Consider a small exporter: without registration, they’d absorb VAT on shipping costs; with it, they recover that tax, boosting margins. In Oman’s VAT system, registration isn’t just a formality—it’s a financial and legal lifeline.

VAT Registration Requirements in Oman

To register for VAT in Oman, businesses must meet specific eligibility criteria and provide documentation, as outlined by the OTA:

-

- Turnover Thresholds:

- Mandatory: Annual taxable supplies exceeding OMR 38,500 (calculated over the past 12 months or projected for the next 30 days).

- Voluntary: Annual taxable supplies between OMR 19,250 and OMR 38,500, or if beneficial (e.g., for input tax recovery).

- Residency: Applies to residents (individuals or entities with a fixed establishment in Oman) and non-residents making taxable supplies in Oman (e.g., via e-commerce).

- Taxable Supplies: Includes goods/services subject to 5% VAT, zero-rated supplies (e.g., exports), but not exempt supplies (e.g., healthcare) unless part of broader taxable activity.

- Documentation:

- Commercial Registration (CR) certificate from the Ministry of Commerce, Industry, and Investment Promotion.

- Valid trade license and activity details.

- Authorized signatory’s ID (e.g., Oman ID or passport).

- Bank account details for VAT payments/refunds.

- Proof of turnover (e.g., financial statements, invoices), if applicable.

- Non-Residents: Must appoint a tax agent in Oman and provide additional details like foreign business registration.

For instance, a Muscat-based café with OMR 40,000 in sales must register, submitting its CR and turnover proof online. The OTA may request additional clarifications, making preparation key.

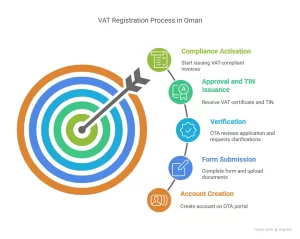

VAT Registration Process

The VAT registration process in Oman is online, efficient, and guided by the OTA portal. Here’s how it works:

- Eligibility Check: Assess whether your taxable turnover exceeds OMR 38,500 (mandatory) or OMR 19,250 (voluntary), or if you’re a non-resident with taxable supplies.

- Account Creation: Log into the OTA e-services portal (taxoman.gov.om) and create a taxpayer account using your business email and contact details.

- Form Submission: Complete the VAT registration form, selecting “mandatory” or “voluntary.” Upload required documents (e.g., CR certificate, ID, turnover evidence).

- Verification: The OTA reviews the application, typically within 5-15 working days. They may request clarifications via email or phone.

- Approval and TIN Issuance: If approved, you receive a VAT certificate with a unique Tax Identification Number (TIN) via email and the portal.

- Compliance Activation: Start issuing VAT-compliant invoices and prepare for quarterly returns, due 30 days after each tax period (e.g., April 30 for January-March).

For example, a Salalah trader applies on January 10, submits documents, gets approved by January 20, and starts charging VAT from February 1. The process is digital but requires accuracy—errors can delay approval.

Who Should Register for VAT in Oman?

VAT registration in Oman applies to specific groups based on turnover, activity, or strategic choice:

- Businesses Above Mandatory Threshold: Any entity (company, sole proprietor, partnership) with taxable supplies over OMR 38,500 annually must register within 30 days of exceeding this limit. E.g., a construction firm with OMR 50,000 in sales.

- Voluntary Registrants: Businesses with taxable supplies between OMR 19,250 and OMR 38,500 can opt in to reclaim input VAT. E.g., a startup spending heavily on taxable inputs like machinery.

- Non-Residents: Foreign entities supplying taxable goods/services in Oman (e.g., online sellers to Omani customers) must register, often via a local tax agent.

- Exporters and Zero-Rated Suppliers: Those dealing in zero-rated supplies (e.g., oil, exports) should register to recover input VAT, even if turnover is below OMR 38,500.

- New Businesses: Entities expecting to exceed OMR 38,500 within 30 days of starting operations must register proactively.

A café with OMR 30,000 in sales might register voluntarily to reclaim VAT on coffee beans, while an unregistered exporter risks losing recoverable tax. Exempt-only suppliers (e.g., schools) typically don’t register unless mixed with taxable activity.

VAT Registration Services in Oman by Xact Auditing

Xact Auditing offers specialized VAT registration services in Oman, leveraging their expertise to simplify and optimize the process. Here’s how they assist:

- Eligibility Assessment: Xact evaluates your turnover (past 12 months or next 30 days) and supply type (taxable, zero-rated, exempt) to determine if you must or should register. For a borderline case (e.g., OMR 37,000 turnover), they advise on voluntary registration benefits.

- Document Preparation: They compile and review required documents—CR certificate, trade license, IDs, turnover proof—ensuring completeness and OTA compliance.

- Online Application: Xact handles the OTA portal submission, filling out forms accurately and uploading files, reducing rejection risks. They monitor progress and address OTA queries.

- Non-Resident Support: For foreign businesses, Xact acts as a tax agent, fulfilling legal requirements and managing registration remotely.

- Post-Registration Guidance: After securing your TIN, they set up VAT-compliant invoicing systems, train staff, and plan your first return, ensuring a smooth transition.

- Tailored Advice: They customize solutions—e.g., advising an exporter on zero-rate benefits or a retailer on input tax recovery—maximizing financial outcomes.

Imagine a small Duqm importer: Xact confirms their OMR 40,000 turnover, submits their application by March 1, secures approval by March 10, and trains them to reclaim import VAT by April. Their tech tools and GCC experience (e.g., UAE VAT since 2018) ensure efficiency, while competitive pricing suits Oman’s SME market.

My Final words..

VAT registration in Oman is a pivotal step for compliance and cost management, and Xact Auditing enhances this process with expertise, technology, and personalized support. Whether you’re mandatory, voluntary, or non-resident, their services ensure you meet OTA standards while optimizing your VAT position. Need more specifics on Xact’s offerings or your business case? Let me know!