Vision 2040’s economic diversification efforts received a boost when Oman rolled out its VAT in April 2021, under Royal Decree No. 121/2020. Apart from complying with VAT, financial audits are necessary for making sure the company follows Oman’s regulations. This article covers how to register for VAT in Oman, what a financial audit is, the types and fees involved and provides a table of well-known companies to help businesses choose the right service.

Understanding VAT Registration in Oman

VAT is collected as 5% tax on goods and services at each step along the way from the start of production to the final sale. VAT has been carried out to lower Oman’s dependency on money from oil. As a result, VAT is charged on almost all goods and services, except those in finance, healthcare, education, local passenger transport and VAT is exempted. Businesses in Oman must register for VAT if their annual taxable supplies equal or exceed OMR 38,500, but those selling outside the country must register no matter their turnover.

Importance of VAT Registration Services

They guide businesses in handling the rules set by the Omani tax authorities and obeying their requirements. These services include:

- Registration Assistance: Preparing and submitting applications to obtain a Tax Identification Number (TIN) and VAT certificate.

- Compliance Support: Issuing compliant VAT invoices, filing quarterly returns, and maintaining records for 10 years (15 years for real estate businesses).

- Advisory Services: Optimizing VAT strategies, managing input tax credits, and ensuring accurate tax calculations.

- Audit Preparation: Supporting businesses during OTA audits to avoid penalties, which can range from OMR 500 to OMR 5,000 for non-compliance.

The use of professional VAT services is necessary to prevent fines, including up to 1% of the total owed each month and 25% of the unpaid amount for incorrect statements which supports smooth operations for a business in Oman.

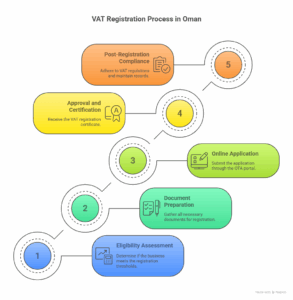

VAT Registration Process in Oman

The VAT registration process in Oman is streamlined through the OTA’s online portal (taxoman.gov.om). Key steps include:

- Eligibility Assessment: Businesses calculate their annual taxable supplies to determine if they meet the mandatory (OMR 38,500) or voluntary (OMR 19,250) registration thresholds.

- Document Preparation: Required documents include:

- Commercial registration number.

- Financial records and business details.

- For non-residents, company identification, tax details from the country of origin, and details of an Omani resident representative.

- Online Application: Log into the OTA portal using electronic authentication (e.g., phone number or ID card), select “VAT liability registration,” and submit the application with accurate details.

- Approval and Certification: Upon approval, the OTA issues a VAT registration certificate, which must be displayed visibly at the business premises.

- Post-Registration Compliance: Businesses must issue VAT invoices, file quarterly returns within 30 days of the tax period, and maintain records for 10 years.

The use of professional VAT services is necessary to prevent fines, including up to 1% of the total owed each month and 25% of the unpaid amount for incorrect statements which supports smooth operations for a business in Oman.

Why Choose Professional VAT and Audit Services?

Engaging professional services offers significant benefits:

- Compliance: Ensures adherence to OTA and CMA regulations, avoiding penalties.

- Efficiency: Streamlines VAT registration, filing, and audit processes, saving time.

- Accuracy: Reduces errors in financial reporting and tax calculations.

- Strategic Insights: Provides recommendations for tax optimization and operational improvements.

- Investor Confidence: Audited financials and compliant VAT filings enhance credibility.

Challenges and Considerations

Businesses should consider:

- Cost: Fees can be high for small businesses; compare quotes for affordability.

- Regulatory Updates: Oman’s VAT and tax laws evolve, requiring firms to stay current.

- Industry Expertise: Choose firms with experience in your sector (e.g., oil, tourism).

- Non-Resident Challenges: Foreign businesses must appoint local representatives for VAT registration.

Xact Auditing in Dubai, UAE, offers VAT registration in the UAE and also provides some of its services in Oman, it says on its website. Xact Auditing operates mainly from the UAE, but its website assures that it can help Omani businesses with VAT registration services. Let’s discuss why Xact Auditing is considered the best pick for VAT registration in Oman, due to their major strengths, variety of services and compliance with local rules. Yet, since very little is known about them here in Oman, I will also explore some aspects and show how their services stand up to well-known local companies. You will find a table comparing Xact Auditing to other auditing services in Oman.

Why Choose Xact Auditing for VAT Registration Services in Oman?

Any business in need of help signing up for VAT services can turn to Xact Auditing, given their reputation as accounting experts in the UAE and what they offer through VAT services for Oman. There are several reasons to choose Xact Auditing for your VAT registration in Oman, related to their service model and what Oman’s VAT system needs:

1. Expertise in VAT Registration and Compliance

Xact Auditing assists with VAT registration, including both required and elective registrations. Oman requires companies with taxable supplies greater than OMR 38,500 to become VAT registered, but those making over OMR 19,250 annually may also choose to register, if they wish. The website says Xact Auditing helps businesses examine their turnover, create the required paperwork and put in an application for a TIN and VAT certificate through the Oman Tax Authority’s (OTA) website. They have worked with the UAE’s federal tax authority, FTA which helps them handle Oman’s Royal Decree No. 121/2020.

2. Streamlined Online Registration Process

Xact Auditing emphasizes a systematic approach to online VAT registration, which is critical in Oman, where the process is managed through the OTA’s digital portal. They guide businesses through:

- Document Preparation: Collecting required documents, such as commercial registration, trade licenses, and identification details of the principal officer.

- Application Submission: Completing the online VAT registration form accurately to avoid rejections.

- Certification: Ensuring businesses receive their VAT certificate promptly upon OTA approval.

Their expertise minimizes errors that could lead to penalties, such as the OMR 2,000 fine for missing VAT registration deadlines. Xact’s familiarity with online tax portals, honed in the UAE, ensures a smooth process for Omani businesses.

3. Comprehensive VAT Services

Beyond registration, Xact Auditing offers a full spectrum of VAT-related services, including:

- VAT Return Filing: Assisting with quarterly filings due within 30 days of the tax period, ensuring timely submissions to avoid 1% monthly penalties.

- VAT Audits: Conducting health checks to ensure compliance with OTA regulations.

- VAT Consultancy: Providing strategic advice on input tax credits, exemptions (e.g., financial services, healthcare), and zero-rated supplies (e.g., exports, basic food items).

- VAT Refunds and Deregistration: Supporting businesses in claiming refunds or terminating VAT registration when applicable.

This holistic approach ensures businesses remain compliant throughout their VAT lifecycle, reducing the risk of fines or audits.

4. Experienced and Qualified Team

There is a team of VAT experts and chartered accountants at Xact Auditing, who bring over 25 years of experience and are trained to handle tax problems in industries including trading, hospitality and IT. Because UAE’s VAT is similar to the GCC and Oman’s 5% VAT rate, they are able to help businesses in Oman comply with rules about recordkeeping for 10 years and the way invoices should be made. Because the team speaks many languages, it helps businesses from all sectors in Oman.

5. Client-Centric and Cost-Effective Services

Xact Auditing receives appreciation from clients for its emphasis on making services that fit client needs and for its responsiveness. Feedback from clients points out that the firm offers top quality service, responds quickly and even finishes an audit report within one day. In Oman, businesses look for services that are within budget and reliable and with Xact’s pricing in line with UAE standards, SMEs and startups could find what they need. Since they have succeeded in clearing clients’ liabilities by canceling FTA fines in the UAE, we expect them to succeed in handling OTA reconsiderations as well.

6. Technology-Driven Solutions

Using advanced accounting software and digital systems, Xact Auditing makes VAT processes simpler, from registration through to filing. In Oman, as digital transformation is central to Vision 2040, their use of technology makes it possible to manage data effectively and obey the OTA’s rules for e-invoicing. This becomes especially important for businesses using cloud-based accounting that includes VAT.

7. Regional Expertise in GCC VAT Systems

As a UAE-based firm with experience in VAT implementation across GCC countries (UAE, Saudi Arabia, Bahrain), Xact Auditing is well-positioned to adapt to Oman’s VAT framework, introduced as the fourth GCC state to implement VAT in April 2021. Their regional knowledge ensures they understand cross-border transaction nuances, which is critical for Omani businesses involved in international trade or non-resident entities requiring VAT registration.

Considerations and Limitations

While Xact Auditing’s capabilities are promising, there are key considerations:

- Limited Evidence of Oman Presence: On the website, Xact Auditing lists VAT registration services for Oman, but it’s hard to find proof of a local office or accreditation at the OTA or CMA. Firms should check how their business will function in Muscat or any other area they plan to serve.

- Competition from Local Firms: Omani companies including BMS Auditing, Excellence Audit & Accounting and Peniel Technology have offices and OTA accreditation which helps them provide local services and easy contact with regulators.

- Regulatory Knowledge: Xact performs well under UAE’s FTA, but businesses still need to verify they understand Oman-specifics like the OTA’s spread-out timeline for registration and those who are not local must get a local representative there.

Why Choose Xact Auditing Over Others?

Xact Auditing stands out for its:

- Regional GCC Experience: Oman’s VAT framework may fit well with what the companies have done in UAE, Saudi Arabia and Bahrain.

- Rapid Service Delivery: Many clients recognize that their fast report delivery is important for hitting the OTA deadlines.

- Cost-Effectiveness: The ability to work with lower costs is very attractive for small and medium-sized enterprises, much more than it is for the Big Four.

- Comprehensive Support: Registering for VAT and auditing can all be handled by Xact, so you won’t need to use several different providers.

Final Say’s

Being a solid provider of VAT registration services in Oman, Xact Auditing is praised on its website for its VAT registration knowledge, plenty of options for clients, use of advanced software and commitment to client service. Because they have experience in a UAE system and GCC region, they are able to handle Oman’s regulations, for instance, the OTA portal and meeting the 5% VAT law. Even so, since there are no known physical bases in Oman, their capabilities there need to be properly confirmed.

Xact Auditing is offering wide range of accounting solutions in UAE such as: