If you own or manage a business in Oman, you cannot ignore VAT registration or delay it; it’s something important and urgent that you need to deal with right away.

Since the VAT framework rolled out, the Ministry of Finance and the Tax Authority have been tightening the screws on compliance. Miss a deadline or file incorrectly, and you’ll face penalties that bite into your profits.

The good news? VAT registration isn’t complicated if you know the process and get the right help. At Xact Auditing, we’ve guided dozens of companies through it, so here’s a straightforward roadmap that actually makes sense.

Why VAT Registration Matters In Oman

VAT in Oman isn’t just another tax form to tick off. It’s how the government keeps the market fair and makes sure companies are playing by the same rules. For business owners, registering sends out a clear message:

- Your books are clean, and you’re serious about running things properly.

- Regulators won’t be breathing down your neck every other month.

Skip registration when you’re supposed to, and it’s not just fines you’ll face. You risk losing credibility with suppliers, banks, and even future investors.

Who Needs To Register For VAT In 2025?

Here’s the deal in 2025:

- If your business is pulling in more than OMR 38,500 a year in taxable sales, registration isn’t optional; it’s a must.

- Smaller setups making over OMR 19,250 can register too, even though it’s voluntary. Many smart owners do this so they can claim input VAT back instead of waiting.

- And don’t assume free zone status keeps you out of it. Depending on how your company is structured and the type of deals you’re making, VAT may still apply.

Think of it this way: registration isn’t just about hitting a number. It’s about deciding whether you want to stay ahead of the rules or risk scrambling later.

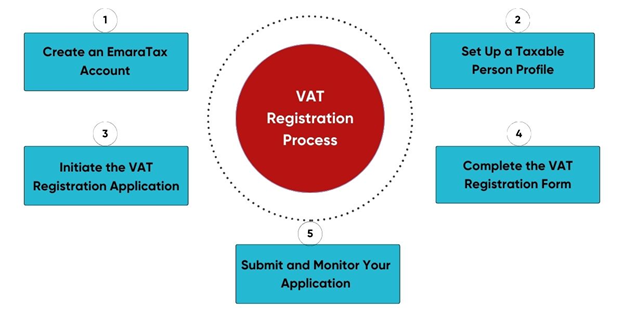

Step-By-Step VAT Registration Process

The registration process isn’t complicated once you break it down. Think of it more like a checklist you can actually follow rather than a pile of paperwork.

Step 1: Figure Out If You Qualify

Start by looking at your last 12 months of sales. Add them up honestly, and no shortcuts. If the total pushes you over the VAT threshold, it’s better to act before the Tax Authority comes knocking. Even if you’re close, planning now saves a lot of stress later.

Step 2: Gather Your Documents

This is where most businesses get stuck. You’ll need:

- Trade license

- Commercial registration certificate

- Shareholder details

- Financial statements (last 12 months minimum)

- Lease agreement for your office

- Bank account details

Messy records mean delays. At Xact Auditing, we’ve seen applications bounce back just because a company uploaded expired trade licenses. Triple-check everything before submitting.

Step 3: Submit Your Application Online

Log in to the Tax Authority portal, complete the VAT registration form, and upload your documents. The system works most of the time, but can hiccup. After you submit, save the confirmation page and the reference number – screenshot it, download the PDF, and file it with your records.

Step 4: Wait For Approval

Processing usually takes 2–4 weeks. If the Authority has questions, they’ll email you. Respond fast. Delayed replies = delayed VAT certificate.

Step 5: Getting Your VAT Certificate

When the Tax Authority approves your application, you’ll be issued a VAT registration certificate. On it, you’ll see your Tax Identification Number (TIN). From that moment, the TIN becomes part of your business identity in Oman; it must be printed on every invoice and official document you issue.

Life After Registration

Receiving the certificate doesn’t mean you can relax. It’s the start of ongoing responsibilities:

- You’ll need to add VAT to all taxable sales.

- File VAT returns every quarter (or on a different schedule if the Authority requires it).

- Maintain proper VAT records for a full 10 years.

And here’s where many owners slip up; even something small, like entering the wrong category for a transaction, can bring penalties. That’s why many firms in Oman choose to work with licensed specialists such as Xact Auditing. Having experts handle compliance means you focus on running your business, not wrestling with forms.

Common Pitfalls Business Owners Face

From our work with clients across Muscat, Sohar, and Salalah, three issues come up again and again:

- Waiting until it’s too late: Some owners only think about VAT after crossing the threshold, which can lead to back-dated liabilities and fines.

- Messy paperwork: Missing IDs, outdated CR extracts, or unsigned documents often delay approvals for weeks.

- Trying to do it all alone: VAT rules shift often, and unless you’re watching every new update, it’s easy to miss something important.

Avoiding these mistakes can save both money and frustration.

Working With Xact Auditing

In Oman, VAT isn’t something you can ignore. It touches pricing, cash flow, and even how your customers view your business. At Xact Auditing, we don’t just file a form and hand it back to you. We sit with you, go through your records, and set up routines that make your VAT reporting accurate quarter after quarter.

Most of our clients tell us the real value isn’t in the paperwork itself. It’s in the peace of mind that comes from knowing they won’t get last-minute notices or penalties. You keep your focus where it belongs, on running and growing your company, while we handle the part that regulators care about.

Ready To Get Started?

VAT registration in Oman is no longer optional. The thresholds are firm, the rules have tightened, and the Tax Authority is stricter than ever. If your sales are already crossing the limit, or even close to it, don’t wait for a warning letter. Get your documents in order now.

Reach out to Xact Auditing today, book a quick consultation, and make sure your business stays compliant without the stress.