Have you noticed how everyone seems to be talking about outsourcing their accounts in Oman lately? It’s not hype. The truth is, 2025 has changed the game – audits are tighter, e-invoicing is everywhere, and the Tax Authority is matching data faster than businesses can blink.

At Xact Auditing, we’ve seen it first-hand. Some companies that once swore by in-house teams are now handing things over to specialists because they’re tired of chasing errors and dreading audits. Outsourcing isn’t just about saving money anymore; it’s become a way to stay sane and stay compliant.

The Changing Business Landscape in Oman

A few years ago, business in Oman felt simpler. Fast forward to today, there’s more variety, more cross-border trade, and a tax system that demands sharper compliance from everyone. Owners are juggling operations, staffing, and growth, all while navigating a tax environment that no longer allows room for mistakes.

In 2025, a few things are shaking up the way finance works in Oman:

- First, the rollout of e-invoicing is leaving businesses with almost no room for late or mismatched reports.

- Second, the tax authority now has data tools that let them match VAT returns with customs records and supplier invoices in minutes, something that used to take weeks.

- And third, some industries like real estate, logistics, and retail are under a magnifying glass, facing tighter checks than before.

All of this means accounting isn’t just “keeping the books” anymore. It’s more about staying ready for whatever the regulators throw at you.

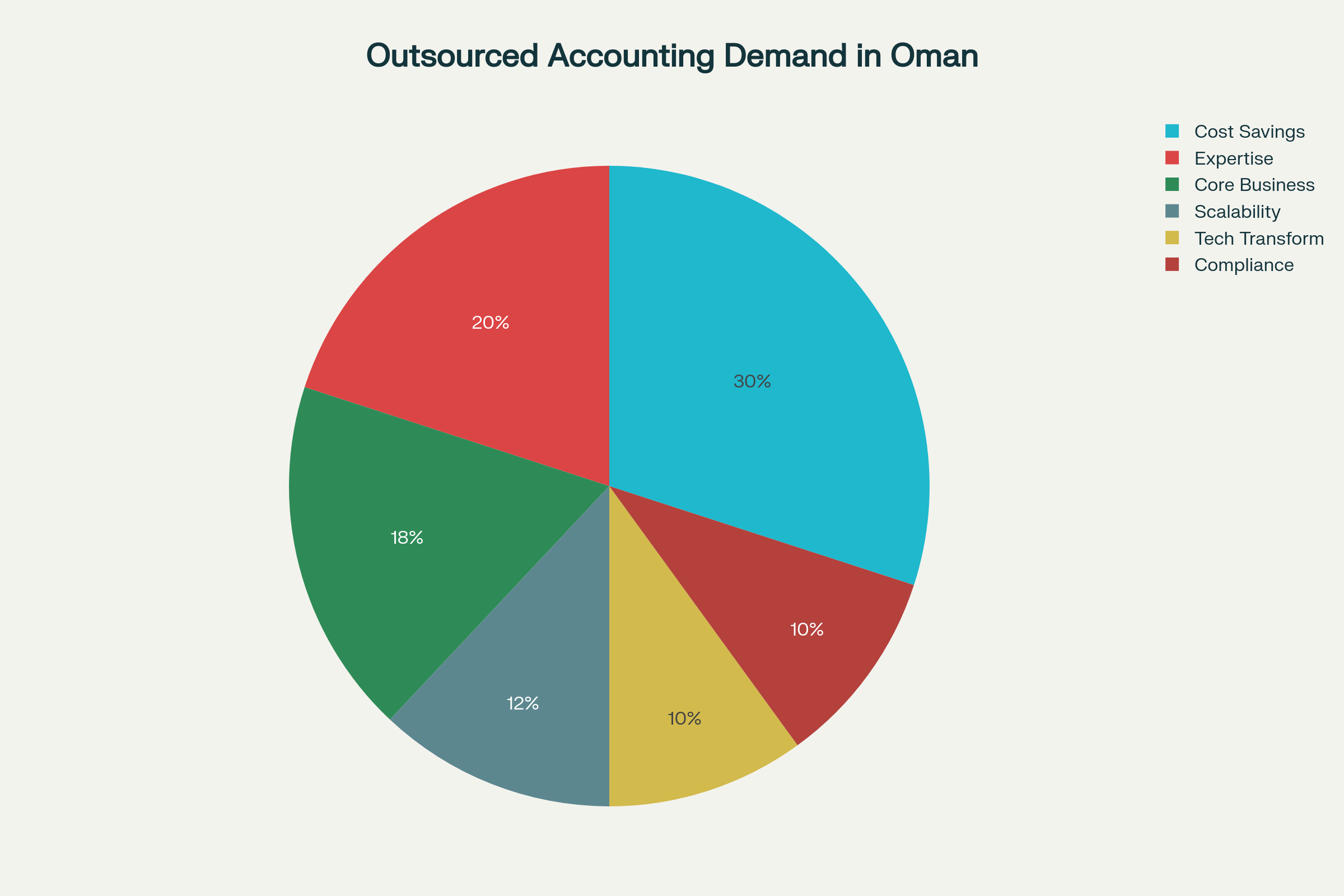

Why Outsourced Accounting Services Are in High Demand

On paper, running your own finance team sounds neat. In reality, it’s expensive and exhausting. Hiring the right people, training them on new VAT rules, buying software, and keeping everything updated can drain smaller businesses quickly. That’s why so many firms are turning to outsourcing instead.

Here’s what’s pulling companies in that direction:

- Saving money without cutting corners → Outsourcing firms split their costs across clients, so even smaller companies get top-level service without the big payroll.

- Specialists who live and breathe the rules → In Oman, regulations change fast. External accountants track updates every day, while in-house staff often lag behind.

- Ready for audits anytime → When the OTA shows up, outsourced teams usually have the files, reconciliations, and invoices already in order.

What Makes 2025 Different

You might wonder: why is everyone suddenly rushing to outsource now, when they could’ve done it years ago? The answer is simple: the way business works in Oman has changed.

- For one, e-invoicing is spreading fast. Companies that still lean on manual paperwork are struggling to keep up, while outsourced firms already run on cloud systems that plug directly into OTA requirements.

- Then there’s the hiring headache. Skilled accountants are scarce, and keeping them is even harder. Outsourcing firms do the heavy lifting here, training and holding onto talent that most small or mid-sized businesses just can’t.

- On top of that, global players expect transparency and international standards from their Omani partners. Outsourced providers are the ones stepping in to meet those demands.

- And let’s not forget the local reality. Plenty of businesses still juggle paper files. Outsourced teams help bridge that gap, turning messy records into digital reports that satisfy today’s rules.

Put together, these aren’t small tweaks; they’re the reasons 2025 feels like a turning point for finance in Oman.

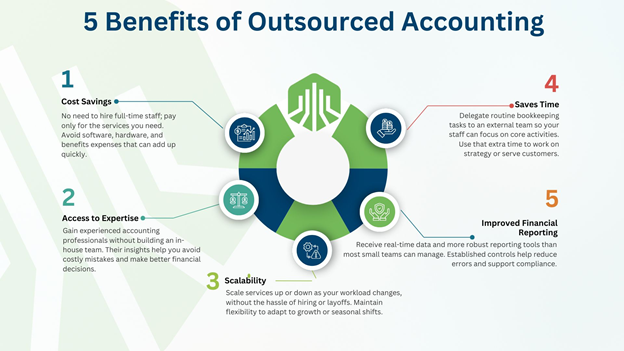

Real Benefits Businesses Notice

When companies hand over their accounting to professionals, the advantages are clear almost immediately. Cash flow reports become cleaner, filing deadlines stop slipping, and tax errors don’t sneak through unnoticed. Owners often say the biggest win isn’t the money saved—it’s the headspace gained.

The benefits usually show up in four ways:

- Clearer financial visibility: decision-making becomes faster and more confident.

- Stronger compliance: penalties and fines are avoided.

- Flexibility: outsourced teams scale up or down as the business grows.

- Time savings: owners can focus on strategy instead of chasing invoices.

It’s about shifting from firefighting to proactive planning.

Clearing Up the Misconceptions

Despite the clear advantages, some business owners in Oman still hesitate. A few myths keep resurfacing, so let’s tackle them.

- “Outsourcing is just for big companies.” In reality, small and mid-sized businesses are the biggest adopters, because they gain the most from reduced costs.

- “I’ll lose control of my accounts.” Not true. Clients receive reports, dashboards, and regular updates. Decisions always remain in the owner’s hands.

- “It’s unsafe to share financial data.” Firms like Xact Auditing use secure systems and strict confidentiality agreements to protect client information.

The fear is understandable, but the reality is that outsourcing gives owners more control, not less.

How Xact Auditing Supports Businesses

At Xact Auditing, outsourcing isn’t just about handling books in the background. It’s about being a long-term partner. We make sure our clients don’t just comply with OTA rules but actually use accounting as a tool to grow.

That means:

- Running pre-audit risk checks so there are no surprises.

- Training finance teams on VAT rules and digital processes.

- Offering real-time dashboards so owners see where they stand at any moment.

- Representing businesses if the OTA initiates an audit.

We don’t wait for problems to appear; we set systems up so they don’t happen in the first place.

Looking Ahead

By the end of 2025, more sectors in Oman will be fully digital in their tax reporting. Companies that still depend on scattered spreadsheets or paper files will find it almost impossible to keep pace. Outsourced accounting will stop being a competitive advantage and become the baseline for survival.

The businesses that act now will adapt smoothly. Those who wait will face penalties, compliance headaches, and missed opportunities.

Talk to Xact Today

Outsourced accounting hasn’t just appeared out of nowhere in Oman; it’s grown because businesses needed a smarter way to handle tighter rules, digital tax systems, and rising costs. Owners are realizing they can either keep putting out fires on their own or lean on experts who already know how to keep the numbers straight.

At Xact Auditing, we don’t just tick compliance boxes; we give you breathing room. In 2025, that matters more than ever. If you’d rather focus on running and growing your business instead of worrying about the next OTA check, our team is here to make sure you’re always one step ahead.