VAT registration is not only a requirement as demanded by the law, however, it is also a chance of businesses to streamline their taxation procedures. Such voluntary registration may be useful saving smaller businesses with opportunity to reclaim the input tax which improves the cash flow. Nevertheless, complying with VAT will be challenging with detailed requirements, such as invoicing and submission of returns (which should be filed 30 days after the tax month). Financial damages and reputation may also occur in the case of non-adherence.

Understanding VAT Returns in Oman

VAT registration is not only a requirement as demanded by the law, however, it is also a chance of businesses to streamline their taxation procedures. Such voluntary registration may be useful saving smaller businesses with opportunity to reclaim the input tax which improves the cash flow. Nevertheless, complying with VAT will be challenging with detailed requirements, such as invoicing and submission of returns (which should be filed 30 days after the tax month). Financial damages and reputation may also occur in the case of non-adherence.

Failure to file a VAT return on time can result in penalties ranging from OMR 500 to OMR 20,000, making timely and accurate filing critical for compliance.

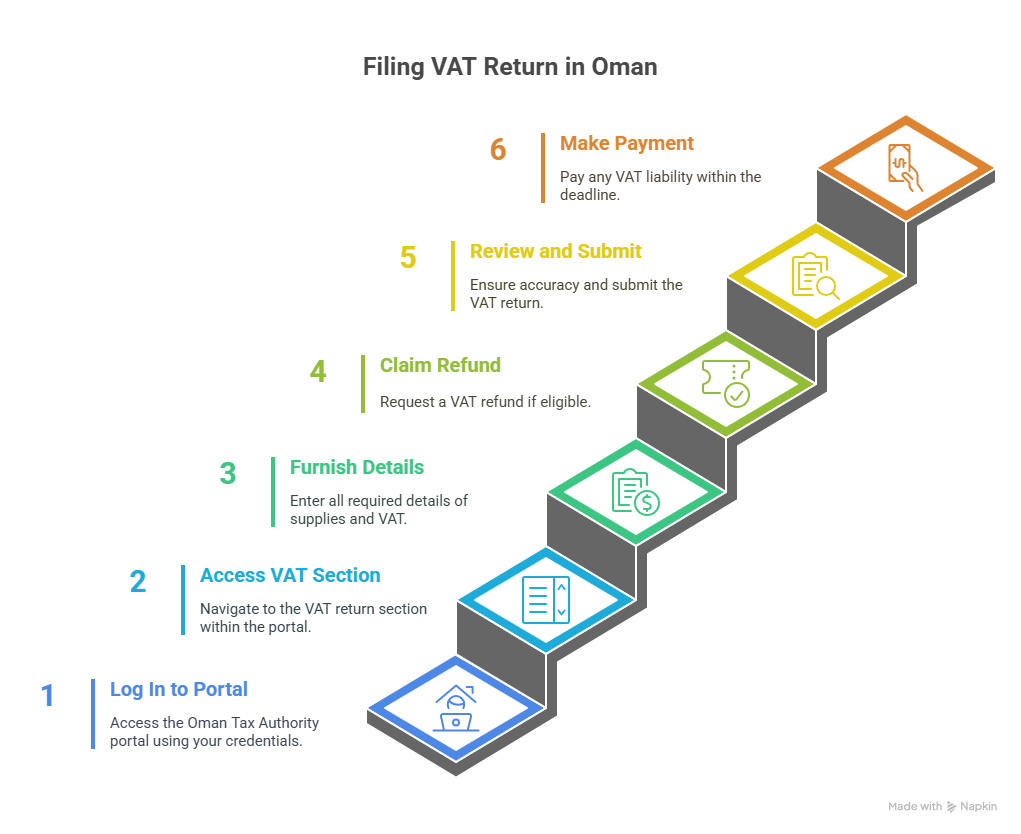

Step-by-Step Guide to Filing a VAT Return in Oman

Step 1: Log In to the Oman Tax Authority Portal

First of all, you need to go to the online platform of the Oman Tax Authority https://tms.taxoman.gov.om/portal/web/taxportal/. Access to your taxpayer account with your credentials on Digital Certification Service (Tam). You don t have an account should you have a business registered with VAT either because it is mandatory should annual supplies be more than OMR 38,500 or because it is voluntary when annual supplies are more than OMR 19,250.

Step 2: Access the VAT Return Section

After logging in, the user will need to go into the portal to the section named VAT returns and choose an option to add a new return. It should be noted that in the ordinary course of things, the system is expected to auto-populate basic taxpayer information which entails your Tax Identification Number (TIN) and the details of your business. Check on these details to be correct.

Step 3: Furnish Details of Supplies and VAT

The VAT return form will make you furnish amalgamated information of all supplies, output and input VATs. The form is constituted of seven main important sections which record different categories of transactions. In the following, the information that was required is broken down:

- Supplies in the Sultanate of Oman: Report the total value of all outward supplies made within Oman, including:

- Standard-rated supplies (taxed at 5%)

- Deemed supplies

- Zero-rated supplies (e.g., exports, international transportation, certain food items)

- Exempt supplies (e.g., financial services, healthcare, education)

- Supplies to other GCC countries

- Purchases Subject to Reverse Charge Mechanism (RCM): Include details of inward supplies (purchases) subject to RCM, such as services or goods purchased from suppliers in other GCC countries or outside the GCC.

- Supplies to Countries Outside Oman: Declare the total value of goods and services exported outside Oman, which are typically zero-rated.

- Import of Goods: Report the total value of goods imported into Oman, including those under the VAT postponement scheme (deferred payment option).

- Total VAT Due: This field is auto-populated based on the output VAT from taxable supplies.

- Input VAT Credit: Declare the total deductible input VAT from taxable purchases, imports, and fixed assets. Only input VAT related to taxable supplies is eligible for deduction.

- Net VAT Liability or Refund: The system calculates the net VAT payable (output VAT minus input VAT) or refundable amount. If input VAT exceeds output VAT, you may be eligible for a refund.

Make sure that all the values are correct since errors may result in penalties or cases of delays during processing. Automation of this step can be achieved by businesses as VAT-compatible software such as TallyPrime will enable accurate VAT return data to be automatically generated based on recorded transactions.

Step 4: Claiming a VAT Refund (If Applicable)

If your input VAT exceeds your output VAT, resulting in a refundable amount greater than OMR 100, you can request a refund by ticking the “I want to be refunded” checkbox on the VAT return form. To claim a refund, download the “Taxpayer Checklist” Excel sheet from the Oman Tax Authority’s website, complete the required details, and attach it to the VAT return form. If the refund is less than OMR 100 or you choose not to claim it, the excess input VAT will be carried forward to offset future VAT liabilities. The Tax Authority typically processes refunds within 30 days, with payment issued within an additional 15 days if approved.

Step 5: Review and Submit the VAT Return

After entering all required details and attaching any necessary documents (e.g., the Taxpayer Checklist for refunds), review the return for accuracy. Click the “SUBMIT” button and confirm the submission by selecting “Yes” in the confirmation prompt. Once submitted, you cannot amend the return after three years from the initial submission date, so ensure all data is correct before finalizing.

Step 6: Make VAT Payment (If Applicable)

If the VAT return indicates a net VAT liability (output VAT exceeds input VAT), you must pay the amount due within 30 days from the end of the tax period. Payments are made electronically through the Oman Tax Authority portal. For imported goods, VAT may be paid at customs or deferred to the VAT return filing date if you’ve applied for the postponement scheme. Late payments incur a penalty of 1% per month or part thereof.

For businesses seeking VAT Return in Oman, consider exploring Business Valuation to assess your company’s worth for strategic decisions or investments. Additionally, engaging reputable Accounting Firms in Oman can provide expert guidance on VAT compliance, auditing, and financial reporting. Check trusted resources or consult firms like BMS Auditing for tailored solutions.

Key Considerations for Accurate VAT Return Filing

- Maintain Proper Records: Oman VAT regulations require businesses to keep records, including tax invoices and accounting books, for at least 10 years (15 years for real estate businesses). These records must be available for Tax Authority audits.

- Understand Supply Types: Accurately categorize supplies as standard-rated (5%), zero-rated (0%), exempt, or out-of-scope. For example, zero-rated supplies include exports and certain food items, while exempt supplies (e.g., financial services) do not allow input VAT recovery.

- Use VAT-Compliant Software: Tools like TallyPrime can automate VAT calculations, generate compliant tax invoices, and produce accurate VAT return data in the prescribed format, reducing errors and saving time.

- Handle Imports and RCM: For imported goods or services under the reverse charge mechanism, ensure VAT is reported correctly. Deferred VAT payments on imports must be included in the VAT return for the relevant period.

- Avoid Penalties: Failure to file returns, submitting incorrect data, or late payments can result in fines. For example, non-filing penalties range from OMR 500 to OMR 20,000, and incorrect records may incur fines from OMR 1,000 to OMR 10,000.

Tips for Staying VAT Compliant

- Prepare Data in Advance: Consolidating supply details (e.g., sales, purchases, imports) can be time-consuming. Use accounting software to streamline data preparation and ensure accuracy.

- Verify Input VAT Eligibility: Only input VAT on purchases related to taxable supplies can be deducted. Exempt supplies do not qualify for input VAT recovery.

- Issue Compliant Invoices: Tax invoices must include mandatory details like the VAT rate, TIN, and supply value in Omani Rials (or converted using the Central Bank of Oman’s exchange rate for foreign currencies). Invoices must be in Arabic, with an English translation available upon request.

- Monitor Deadlines: File and pay VAT within 30 days of the quarter’s end to avoid penalties. Set reminders for key dates, such as October 30 for the July–September quarter.

- Seek Professional Assistance: If VAT compliance feels overwhelming, consult a chartered accountant or tax advisor, such as R. Tulsian & Co. LLP in Muscat, for expert guidance.

Why Use TallyPrime for VAT Compliance?

TallyPrime, a leading business management software, is tailored for Oman VAT compliance. It simplifies the process by:

- Automating VAT calculations for taxable, zero-rated, and exempt supplies.

- Generating bilingual (Arabic and English) tax invoices.

- Producing accurate VAT return data in the Tax Authority’s prescribed format.

- Detecting and correcting errors in transactions to ensure compliance.

- Managing reverse charge mechanism transactions and deferred VAT payments on imports.

Businesses can book a free demo of TallyPrime to explore its features and ensure a seamless transition to VAT compliance.

Final Thoughts

VAT registration in Oman is a simple but very essential undertaking to ensure that businesses are operating within the taxation requirements of the Sultanate. Businesses can easily obtain their VAT certificate by organizing the necessary papers, e.g. commercial registration, identification, and bank information, and go about the registration steps as required by the OTA online. Being knowledgeable of the VAT requirements and ensuring good records and consulting with the professional whenever required will guarantee the effortless compliance and serve the economic planning of Oman.