Because Oman’s economy is becoming more diversified as part of Vision 2040, more companies need robust financial audit services. When businesses try to comply with many requirements and keep things transparent, financial audits are very important for their success. In this article, readers will learn about financial audit services in Oman, including their definition, work process, the types available and the charges, as well as the main audit firms in the country.

What is a Financial Audit?

An independent and objective financial audit looks at a company’s financial statements to ensure they are correct, complete and compliant with accounting rules such as IFRS. Auditing ensures that the balance sheets, income statements, cash flow statements and equity statements of a company in Oman do not contain significant mistakes, so stakeholders will feel confident about the organization’s finances. Audits make a business more credible, assist in following the rules, help uncover inefficiencies, decrease risks and raise work performance.

Importance in Oman

Financial audits are required for Omani companies such as limited liability companies with over OMR 50,000, joint-stock companies with over ten shareholders and entities whose articles set audits as a requirement. According to Oman Tax Authority, Capital Market Authority (CMA) and Central Bank of Oman, audited financial statements are necessary to confirm compliance with Income Tax Law (Sultani Decree 28/2009, amended by 9/2017) and VAT regulations (Royal Decree 121/2020). Having audits provides some sort of guarantee to investors, lenders and regulators which supports Oman’s business growth.

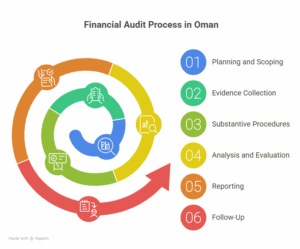

The Financial Audit Process in Oman

The financial audit process in Oman follows a structured approach aligned with Generally Accepted Auditing Standards (GAAS) and IFRS. The process typically involves the following steps:

- Planning and Scoping:

- Auditors assess the company’s operations, industry, and risks to define the audit’s scope.

- A planning meeting with management outlines timelines, objectives, and key areas of focus.

- Auditors evaluate the company’s internal controls and financial reporting systems.

- Evidence Collection:

- Auditors gather evidence by reviewing financial records, journal entries, ledgers, and supporting documents (e.g., invoices, contracts).

- They test internal controls to ensure they prevent misstatements and verify the existence, ownership, and valuation of assets and liabilities.

- Substantive Procedures:

- Detailed testing of financial transactions and account balances ensures accuracy and compliance with IFRS.

- Procedures include verifying revenue recognition, inventory valuation, and tax calculations.

- Analysis and Evaluation:

- Auditors analyze findings to identify discrepancies, fraud risks, or inefficiencies.

- They assess whether financial statements present a “true and fair” view of the company’s financial position.

- Reporting:

- The auditor issues a report with an opinion: unqualified (clean), qualified, adverse, or disclaimer, depending on findings.

- The report is submitted to management, shareholders, and, if required, regulatory bodies like the CMA.

- Follow-Up:

- Auditors provide recommendations for improving internal controls or processes.

- Companies address identified issues to prepare for future audits.

In Oman, the process is tailored to local regulations, ensuring compliance with the Oman Commercial Law and tax requirements, such as the 15% corporate tax (3% for qualifying small businesses) and 5% VAT.

Types of Financial Audits in Oman

Financial audits in Oman can be categorized into several types, each serving a distinct purpose:

- External Audits:

- Conducted by independent certified public accountants (CPAs) to provide an unbiased opinion on financial statements.

- Mandated for listed companies, banks, and certain LLCs to ensure compliance with CMA and IFRS standards.

- Enhances credibility for investors and lenders.

- Internal Audits:

- Performed by in-house or outsourced auditors to evaluate internal controls, risk management, and operational efficiency.

- Focuses on identifying process improvements and preventing issues before external audits.

- Common in large organizations to enhance governance.

- Tax Audits:

- Conducted to verify compliance with Oman’s tax laws, including corporate tax and VAT.

- Ensures accurate tax filings and prevents penalties from the Oman Tax Authority.

- Compliance Audits:

- Assess adherence to specific regulatory requirements, such as those set by the CMA or Central Bank of Oman.

- Common in regulated industries like banking and insurance.

- Due Diligence Audits:

- Performed during mergers, acquisitions, or investments to evaluate financial health and risks.

- Critical for assessing the value and viability of potential deals.

- Sales Audits:

- Analyze sales processes, performance, and compliance with company policies.

- Help optimize revenue generation and team accountability.

Each type addresses specific needs, from regulatory compliance to strategic decision-making, making financial audits versatile tools for businesses in Oman.

Fees for Financial Audit Services in Oman

Audit fees in Oman vary based on several factors, including:

- Company Size and Complexity: Larger companies with complex operations incur higher fees due to increased audit effort.

- Industry: Regulated sectors like banking and insurance require specialized audits, increasing costs.

- Firm Reputation: Top-tier firms, such as the Big Four (KPMG, PwC, Deloitte, EY), typically charge higher fees than local firms.

- Scope of Services: Comprehensive audits involving tax, VAT, and due diligence are more expensive than basic financial statement audits.

- Financial Record Quality: Poorly maintained records require more auditor time, raising fees.

Fee Estimates

- Small Businesses (Revenue < OMR 100,000): OMR 500–2,000 for basic financial audits.

- Medium Enterprises: OMR 2,000–10,000, depending on complexity and industry.

- Large Corporations and Listed Companies: OMR 10,000–50,000+, especially for Big Four firms or regulated sectors.

- Specialized Audits (e.g., Due Diligence, Tax Audits): OMR 3,000–20,000, depending on scope.

In a 2022 analysis of audit costs in Oman during COVID-19, it was discovered that more intense risks and greater work complexity meant higher audit fees for companies, especially from the Big Four. Management often holds discussions with the audit firm on the fees, under supervision by the audit committee to maintain quality.

Benefits of Financial Audit Services in Oman

Engaging professional audit services in Oman offers several advantages:

- Compliance: Ensures adherence to Oman’s tax laws, IFRS, and CMA regulations, avoiding penalties.

- Transparency: Enhances credibility with investors, lenders, and stakeholders through accurate financial reporting.

- Risk Mitigation: Identifies fraud, errors, and inefficiencies, protecting the business from financial losses.

- Operational Improvement: Provides insights into process optimization and cost reduction.

- Investor Confidence: Audited financial statements attract external financing and support business growth.

Challenges and Considerations

Businesses should consider potential challenges when selecting audit services:

- Cost Variability: Fees can strain budgets, especially for SMEs. Comparing quotes from multiple firms is advisable.

- Industry Expertise: Firms must understand the client’s sector (e.g., oil and gas, tourism) to provide relevant insights.

- Regulatory Changes: Oman’s evolving tax laws, such as VAT and corporate tax updates, require auditors to stay current.

Why Choose a Firm Like Xact Auditing for Accounting Services in Oman?

Xact Auditing stands out in Dubai for being a leading audit and accounting firm that uses diverse services suitable for businesses in Oman. The following are main reasons why such a firm with Xact Auditing’s traits could succeed as an accounting service provider in Oman:

- Comprehensive Service Offerings

Xact Auditing provides a broad spectrum of financial services, which are critical for businesses operating in Oman’s regulatory landscape. These include:

- Audit Services: Financial audits, internal audits, tax audits, and liquidation audits, ensuring compliance with international standards like the International Standards of Auditing (ISA) and International Financial Reporting Standards (IFRS). In Oman, where compliance with the Oman Tax Authority and Capital Market Authority (CMA) is essential, such expertise is invaluable.

- Accounting and Bookkeeping: Accurate recording and management of financial transactions, which is crucial for businesses to maintain compliance with Oman’s 15% corporate tax and 5% VAT requirements.

- VAT Services: Comprehensive support for VAT registration, filing, refunds, audits, and consultancy, which is particularly relevant in Oman following the introduction of VAT under Royal Decree No. 121/2020.

- Corporate Tax Services: Guidance on corporate tax registration and filing, helping businesses navigate Oman’s tax framework effectively.

- Business Setup and Advisory: Assistance with company formation, trade licenses, and feasibility studies, which are vital for new businesses entering Oman’s market.

A firm with such a diverse service portfolio can provide end-to-end financial solutions, reducing the need for businesses to engage multiple providers.

- Expertise in Regional Regulations

Due to Xact Auditing’s knowledge of UAE rules like VAT, corporate tax and business regulations, it should be able to adjust to the rules in Oman. Financial businesses in Oman are regulated by the country’s standards from the OACPA and FSA. Xact, given its regional knowledge, could design solutions to ensure a business complies with rules, manages its tax burdens and prevents fines. Oman depends on VAT expertise from professionals to ensure VAT filings are correct and avoid fines.

- Client-Centric Approach

Xact Auditing puts priority on serving clients, offers quality over quantity and designs solutions that fit clients’ unique needs. In Oman, working as an accountant is extra useful since businesses come in all sizes, covering areas such as oil and gas, factories and tourism. Because they deeply understand what their clients go through, they offer tailored solutions that boost financial openness and growth for Omani companies. Feedback from clients focuses on how fast Xact acts, delivers on time and provides plenty of support, all of which are vital for success in today’s market.

- Technology-Driven Solutions

Xact Auditing makes use of the latest accounting techniques, both with digital and paperless systems. Owing to the rising adoption of cloud technology in business, a firm with Xact’s know-how might introduce advanced accounting software to improve efficiency, accuracy and the ability to grow. Their offer of digital accounting is in step with Oman gradually shifting its business operations to digital methods.

- Experienced and Qualified Team

Those responsible for Xact Auditing possess over two decades of experience in accountancy and can provide solutions for any difficult financial problems in any industry. Omanese businesses with strong workforces can deliver audits and helpful insights that help investors and comply with regulations. Thanks to the varied team, made up of members from different parts of the world, they can respond well to the varied needs of Oman’s many cultures.

- Cost-Effectiveness

Xact Auditing’s excellent and affordable services appeal to SMEs as well as larger businesses. In Oman, where reducing costs is important to many businesses, outsourcing accounting to Xact is more cost-effective than implementing an in-house team. Thanks to their cost-effectiveness and strong focus on quality, companies that look for value in services will find them a good fit.

- Reputation and Trust

It is well known in the UAE that Xact Auditing is regarded by top banks and included among Dubai’s leading auditing companies. Thanks to its reputation, Oman could become an attractive place for companies to partner with trustworthy businesses, since having respected partners can raise their standing with all financial partners. When they follow ethical standards and best practices worldwide, their attraction increases.

- Support for Business Growth

As well as following rules, Xact Auditing looks for strategic opportunities to help businesses work more efficiently and perform well. Since diversity in the economy is emphasized by Oman’s Vision 2040, a firm possessing Xact’s expertise can provide guidance on budgeting, risk control and reaching new markets to Omani businesses. Omani companies can rely on them to find best growth options and improve how they use their resources.

Considerations for Choosing Xact Auditing in Oman

While Xact Auditing’s profile suggests it could be a strong candidate for accounting services, there are important considerations:

- Limited Documented Presence in Oman: Unlike firms like BMS Auditing, Excellence Audit & Accounting Services, or Peniel Technology, which have established operations in Oman, Xact Auditing’s primary focus is in the UAE. Businesses in Oman should verify whether Xact has a physical presence or partnerships in the Sultanate to ensure seamless service delivery.

- Industry-Specific Expertise: Businesses should confirm whether Xact’s experience aligns with their industry, as Oman’s economy includes unique sectors like oil and gas, tourism, and logistics, which require specialized knowledge.

- Local Regulatory Knowledge: While Xact excels in UAE regulations, ensuring their familiarity with Oman’s specific tax laws, such as VAT implementation and corporate governance practices, is crucial.

Final Talk

Having your finances audited in Oman helps maintain your business’s integrity, follows necessary regulations and aids in your growth. Using a set process and different kinds of audits—external, internal, tax, compliance and due diligence—BMS Auditing, Excellence Audit & Accounting, Peniel Technology and the Big Four supply valuable assistance to businesses. The cost of a professional audit depends on the business’s size, complexity and its reputation, but such investment brings new transparency, cuts down on risks and supports the trust of stakeholders. When Oman is opening up its economy, businesses can thrive by working with a trusted audit firm that knows the market well.

You can call BMS Auditing or Excellence Audit & Accounting for customized services in audit or check with the Big Four firms if you are a big company. You should always make sure the firm is registered by the CMA and Ministry of Commerce, Industry and Investment Promotion for verification of quality.