Value Added Tax (VAT) was introduced in Oman on April 16, 2021, as a form of economic diversification following by the Gulf Cooperation Council (GCC) VAT scheme. VAT registration is a mandatory compliance to be done by the businesses operating in Oman which may be a mandatory requirement or a voluntary one subject to the turnover of the business or nature of the business. This paper describes these documentation and procedures that need to be followed during the VAT registration in Oman so that a business can streamline the process and also comply with the rules as set forth by Oman Tax Authority (OTA).

Understanding VAT Registration in Oman

The standard rate of VAT in Oman is 5 per cent imposed on taxable supply with some goods and services either zero-rated or exempted. Voluntary registration is optional by businesses with a turnover above OMR 19,250 whilst mandatory registration is when the annual taxable turnover reaches OMR 38,500. In Oman, Non- residents’ businesses that supply taxable services in the country are subject to registration irrespective of turnover. Online registration using the portal of the OTA is mainly carried out, and a certain documentation is necessary to complete the application and succeed in it.

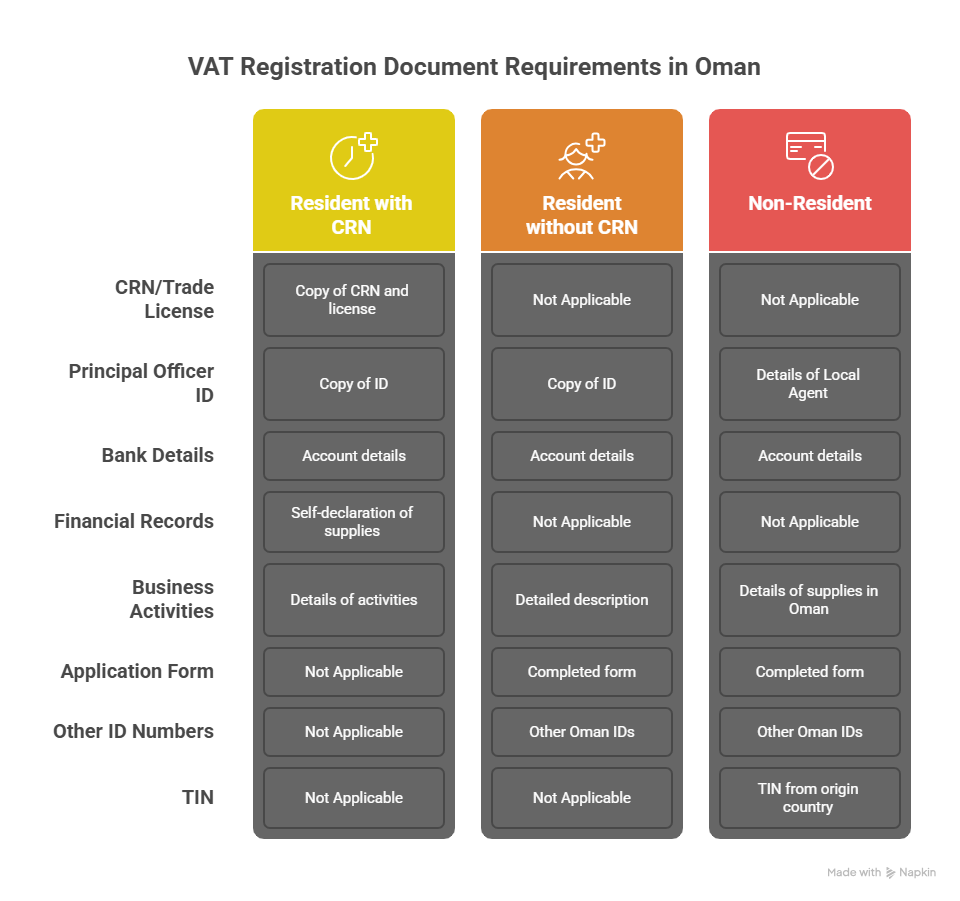

Key Documents for VAT Registration

It is compulsory to present the documents that declare the identity of a business, its operation, and compliance capability to vtax in order to be registered as VAT in Oman. The necessary documentation differs a bit based on the question of the business being a resident that has a Commercial Registration Number (CRN), a resident that does not have a CRN and a non-resident company. Here is the checklist of the documents usually required:

For Resident Businesses with a Commercial Registration Number (CRN)

- Copy of Commercial Registration and Trade License: A valid CRN and trade license issued by the Ministry of Commerce, Industry, and Investment Promotion, proving the business’s legal establishment in Oman.

- Identification of the Principal Officer: A copy of the residency card, Oman civil ID, or passport of the principal officer or responsible person managing the business’s VAT obligations.

- Bank Account Details: Details of the business’s bank account, including the account number, bank name, and branch details, to facilitate VAT payments and refunds.

- Financial Records or Self-Declaration of Annual Supplies: While audited financial statements are not mandatory, businesses must provide a self-declaration of annual taxable supplies to confirm eligibility for mandatory or voluntary registration.

- Details of Business Activities: Information about the nature of the business, including commercial, industrial, or professional activities, to determine taxable supplies.

For Resident Businesses without a CRN

- Application Form: A completed VAT registration application form, available for download from the OTA website, containing:

- Name, address, legal form, and contact details of the entity.

- Any other Oman identification numbers (e.g., for Corporate Income Tax, Excise/Selective Tax, Customs, or Free/Special Zone registrations).

- Identification of the Principal Officer: Similar to CRN holders, a copy of the Oman civil ID, residency card, or passport of the principal officer.

- Bank Account Details: As required for CRN holders, to ensure proper financial transactions with the OTA.

- Business Activity Details: A detailed description of the business’s taxable activities to confirm VAT liability.

For Non-Resident Businesses

Non-resident businesses providing taxable supplies in Oman must register regardless of turnover, with no minimum threshold. The required documents include:

- Application Form: A completed VAT registration form for non-residents, available on the OTA website, including:

- Name, address, and nature of the legal entity.

- Tax Identification Number (TIN) from the country of origin.

- Details of the Responsible Person: Information about a local Oman-based agent or representative (name, address, contact details, and Oman civil ID), who must be an Omani resident to act as the responsible person for VAT obligations.

- Bank Account Details: Details of a bank account, preferably in Oman, for VAT-related transactions.

- Business Activity Information: Details of the taxable supplies provided in Oman, including the date of the first expected supply for VAT purposes.

- Other Identification Numbers: Any relevant Oman identification numbers for Corporate Income Tax, Excise/Selective Tax, Customs, or Free/Special Zone registrations, if applicable.

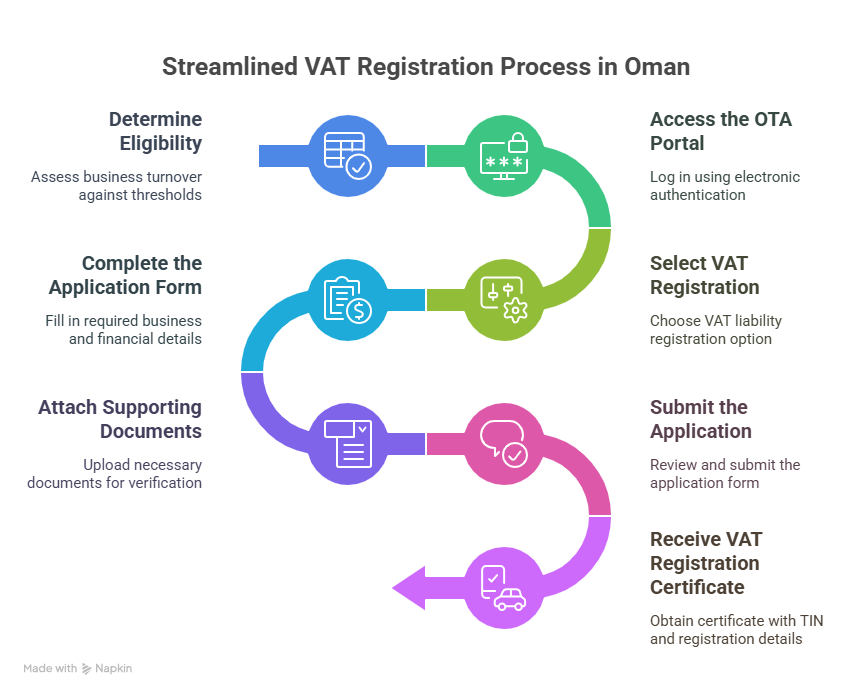

Step-by-Step VAT Registration Process

The VAT registration process in Oman is streamlined through the OTA’s online portal (https://taxoman.gov.om). Below are the steps to follow:

- Determine Eligibility: Assess whether your business meets the mandatory (OMR 38,500) or voluntary (OMR 19,250) registration thresholds by calculating taxable supplies using the “backward look” (past 12 months) or “forward look” (next 12 months) tests. Non-residents must register regardless of turnover.

- Access the OTA Portal: Log in to the OTA’s taxpayer portal using electronic authentication (via phone number or ID card reader).

- Select VAT Registration: Navigate to E-Services, select “Registration of a Taxpayer,” and choose “VAT Liability Registration.” For CRN holders, enter the CRN to auto-populate business details.

- Complete the Application Form: Fill in the required fields, including business details, principal officer information, and bank account details. For non-CRN residents and non-residents, download and complete the respective application forms.

- Attach Supporting Documents: Upload the necessary documents (e.g., CRN, trade license, ID, or TIN for non-residents). Ensure all documents are accurate to avoid delays.

- Submit the Application: Review the form, save a draft if needed, and submit it. Keep the receipt for reference.

- Receive VAT Registration Certificate: Once approved (typically within one working day for complete applications), the OTA issues a VAT registration certificate with a Tax Identification Number (TIN) and details such as the registration date and tax period.

Additional Considerations

- VAT Certificate Display: Businesses must display the VAT registration certificate in a visible location at their premises.

- Record-Keeping: VAT-registered businesses must maintain records, including original tax invoices, for 10 years (15 years for real estate businesses). Records can be kept electronically, subject to OTA regulations.

- Penalties for Non-Compliance: Failure to register, late filing, or non-display of the VAT certificate can result in penalties ranging from OMR 500 to OMR 5,000, or a fine of OMR 2,000 for missing registration deadlines.

- VAT Invoicing: VAT invoices must include the supplier’s name, address, VATIN, “Tax Invoice” label, a detailed description of goods/services, VAT amount, and total amount payable.

- Group VAT Registration: Related entities can register as a VAT group to file a single return, provided they meet financial, economic, and organizational linkage criteria.

- Exemptions and Zero-Rated Supplies: Businesses dealing exclusively in zero-rated supplies (e.g., certain exports, medicines) may request exemption from registration, subject to OTA approval.

Why Compliance Matters

VAT registration is not only a requirement as demanded by the law, however, it is also a chance of businesses to streamline their taxation procedures. Such voluntary registration may be useful saving smaller businesses with opportunity to reclaim the input tax which improves the cash flow. Nevertheless, complying with VAT will be challenging with detailed requirements, such as invoicing and submission of returns (which should be filed 30 days after the tax month). Financial damages and reputation may also occur in the case of non-adherence.

For businesses seeking comprehensive financial services in Oman, consider exploring Business Valuation to assess your company’s worth for strategic decisions or investments. Additionally, engaging reputable Accounting Firms in Oman can provide expert guidance on VAT compliance, auditing, and financial reporting. Check trusted resources or consult firms like BMS Auditing for tailored solutions.

Seeking Professional Assistance

Companies without prior knowledge of how to go about registering themselves on the VAT system in Oman can ease this process by seeking the services of professional bodies in the form of chartered accountants or tax advisors in Oman. Companies, such as BMS Auditing or GSPU & Associates, will provide customized VAT registration services and they guarantee correct documentation, safe handling, and OTA importation requirements. Such services are especially useful to non-residents, or to businesses with cross-border expansion.

Last Thought

VAT registration in Oman is a simple but very essential undertaking to ensure that businesses are operating within the taxation requirements of the Sultanate. Businesses can easily obtain their VAT certificate by organizing the necessary papers, e.g. commercial registration, identification, and bank information, and go about the registration steps as required by the OTA online. Being knowledgeable of the VAT requirements and ensuring good records and consulting with the professional whenever required will guarantee the effortless compliance and serve the economic planning of Oman.