Bookkeeping is the systematic recording, organizing, and maintaining of a business’s financial transactions on a day-to-day basis. It forms the foundation of accounting by tracking income, expenses, assets, liabilities, and equity in a structured manner, typically using ledgers or software. In Oman, where businesses must comply with tax laws (e.g., VAT at 5% and corporate tax at 15% or 3% for SMEs), bookkeeping ensures accurate financial data for tax filings, audits, and decision-making.

- Core Activities: Recording sales invoices, purchase receipts, payments, payroll, and bank transactions. For example, a Muscat retailer logs OMR 1,000 in daily sales and OMR 200 in supplier payments.

- Purpose: Provides raw data for financial statements (e.g., profit and loss, balance sheet), tax calculations, and regulatory compliance with the Oman Tax Authority (OTA).

- Methods: Can be single-entry (simple, for small businesses) or double-entry (standard, balancing debits and credits), often digitized via tools like QuickBooks or Xero.

A construction firm, for instance, uses bookkeeping to track OMR 50,000 in revenue and OMR 20,000 in material costs, ensuring it can claim VAT input tax and compute corporate tax on OMR 30,000 profit.

Types of Bookkeeping Services

Bookkeeping services vary based on business needs, complexity, and compliance requirements. In Oman, the following types are commonly offered:

- General Bookkeeping: Day-to-day recording of transactions—sales, purchases, payments, and receipts. Suitable for SMEs like a café tracking OMR 500 daily sales and OMR 100 in expenses.

- Payroll Bookkeeping: Managing employee wages, deductions (e.g., social security), and payments. A factory with 20 workers might use this to log OMR 10,000 monthly payroll.

- Accounts Receivable/Payable Management: Tracking money owed to/by the business. A supplier owed OMR 5,000 by clients or owing OMR 3,000 to vendors benefits from this service.

- Bank Reconciliation: Matching bank statements with ledger entries to catch errors or fraud. E.g., reconciling OMR 15,000 in bank deposits with recorded sales.

- VAT Bookkeeping: Recording VAT charged (output tax) and paid (input tax) for quarterly filings. A retailer charging OMR 50 VAT on OMR 1,000 sales and reclaiming OMR 20 on purchases uses this.

- Year-End Bookkeeping: Preparing financials for annual audits and tax returns, mandatory in Oman under IFRS standards for corporate tax.

- Specialized Bookkeeping: Tailored for industries like oil and gas (tracking high-value assets) or retail (inventory management).

For example, an exporter might combine VAT and general bookkeeping to record zero-rated sales (OMR 100,000) and reclaim OMR 5,000 in input VAT, ensuring compliance and recovery.

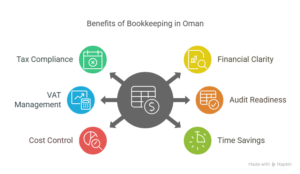

Benefits of Bookkeeping Services in Oman

Bookkeeping services deliver significant advantages for Omani businesses, particularly in a regulated tax environment:

- Tax Compliance: Accurate records ensure timely VAT (quarterly, due within 30 days) and corporate tax filings (annual, due within four months). A firm avoids OMR 2,000 penalties for late corporate tax submission.

- Financial Clarity: Provides real-time insights into cash flow, profits, and expenses. A trader sees OMR 10,000 profit monthly, guiding investment decisions.

- VAT Management: Tracks input/output VAT for reclaims or payments. An SME reclaims OMR 1,000 quarterly, improving liquidity.

- Audit Readiness: Prepares businesses for OTA audits (up to five years back) with IFRS-compliant records, avoiding fines or adjustments.

- Cost Control: Identifies overspending or inefficiencies. A manufacturer spots OMR 5,000 in unnecessary costs via detailed expense logs.

- Time Savings: Frees business owners from manual record-keeping, letting them focus on growth. An SME owner outsources OMR 30,000 annual bookkeeping instead of hiring full-time staff.

- Legal Protection: Well-kept books defend against disputes or OTA penalties (e.g., 1% monthly interest on unpaid tax).

A Salalah retailer, for instance, uses bookkeeping to file OMR 2,500 in VAT quarterly, claim OMR 1,000 back, and prepare a OMR 50,000 income tax return—all while staying audit-ready.

Corporate Tax Services in Oman by Xact Auditing

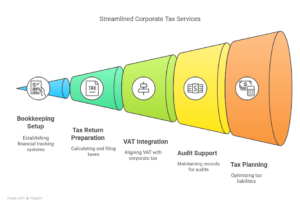

While your request includes “Corporate Tax Services in Oman by Xact Auditing” under bookkeeping topics, I’ll integrate bookkeeping relevance and expand on Xact’s corporate tax offerings, as they often overlap. Xact Auditing provides robust corporate tax services in Oman, leveraging bookkeeping as a foundation:

Tax Registration and Bookkeeping Setup: Xact registers businesses with the OTA for a tax card and establishes bookkeeping systems to track taxable income. For an SME with OMR 100,000 revenue, they ensure records qualify for the 3% rate (OMR 3,000 tax) versus 15% (OMR 15,000).

Return Preparation: Using bookkeeping data, they compute taxable profits (revenue minus deductions) and file returns by April 30 for a December year-end. A firm with OMR 80,000 income and OMR 20,000 expenses pays OMR 9,000 at 15%.

VAT and Corporate Tax Integration: Xact aligns VAT bookkeeping (e.g., OMR 5,000 output tax, OMR 2,000 input tax) with corporate tax, ensuring deductible expenses are VAT-compliant and reducing net tax liability.

Audit Support: They maintain five-year records (15 for real estate) per OTA rules, reconciling bank statements and ledgers for audits. A client facing a three-year OTA review relies on Xact’s organized books.

Tax Planning: Xact uses bookkeeping insights to optimize tax—e.g., carrying forward a OMR 10,000 loss to offset next year’s profit, or securing SME status for a 3% rate.

Technology Tools: Their OTA-compliant software automates bookkeeping and tax calculations, syncing OMR 50,000 in sales and OMR 30,000 in costs for accurate filings.

Industry Expertise: For petroleum firms (55% rate) or exporters, Xact tailors bookkeeping and tax strategies, ensuring high-value transactions (e.g., OMR 1 million oil sales) are correctly taxed.

Imagine a Duqm manufacturer: Xact sets up daily bookkeeping for OMR 200,000 annual revenue, files a OMR 27,000 corporate tax return (15% on OMR 180,000 profit), and reclaims OMR 5,000 in VAT—all seamlessly linked. Their GCC experience (e.g., UAE tax since 2018) and SME-friendly pricing enhance their appeal.

Conclusion

Bookkeeping is the backbone of financial and tax management in Oman, supporting VAT (5%) and corporate tax (15%, 3%, or 55%) compliance. Its types—general, payroll, VAT—cater to diverse needs, while benefits like cost control and audit readiness drive business success. Xact Auditing ties this to corporate tax services, offering end-to-end solutions from bookkeeping setup to tax filing, optimized by tech and expertise. Whether you’re an SME or a multinational, their approach ensures accuracy and savings. Need more on Xact’s bookkeeping specifics or your scenario? Let me know!