The active business environment of Oman requires deep financial management to uphold both regulatory rules and business development needs from industries such as oil and gas and manufacturing and tourism. Audit firms function as essential entities because they provide financial transparency along with regulatory compliance and business operational enhancement services.

Xact Auditing positions itself as a notable audit firm in Oman using innovative methods and client-oriented solutions despite its main operational base in Dubai United Arab Emirates that supports customers throughout the GCC including Omani entities. This article evaluates the top auditing companies in Oman by their characteristics and demonstrates why Xact Auditing offers specific advantages and sales benefits while providing solutions to commonly requested information.

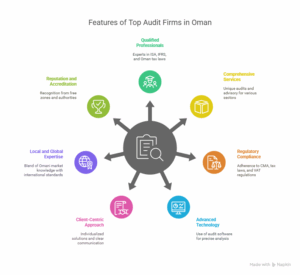

Features of the Best Audit Firms in Oman

Top audit firms in Oman share distinct features that set them apart:

- Qualified Professionals: The company should recruit experts from the field who specialize in ISA and IFRS reporting standards together with Oman tax legislation.

- Comprehensive Services: The audit company provides unique audits and advisory services for banking, real estate, and manufacturing businesses together with financial auditing, tax auditing, risk management, and internal auditing and stock audits..

- Regulatory Compliance: The company upholds CMA compliance requirements together with Omani Income Tax Law provisions such as 10% tax on profits exceeding OMR 100,000 as well as VAT regulations that became effective since April 2021.

- Advanced Technology: The organization should employ advanced audit software and tools to analyze finances precisely while improving reporting effectiveness.

- Client-Centric Approach: The company delivers individualized answers while maintaining clear dialogue together with strategic knowledge that helps customers fulfill their unique objectives.

- Local and Global Expertise: Our organization combines experience of the Omani market with international business standards to serve listed companies together with SMEs.

- Reputation and Accreditation: The organization enjoys recognition status from free zones as well as authority endorsement from the Ministry of Commerce, Industry, and Investment Promotion and all banking entities.

These features enable firms to deliver audits that enhance financial credibility and support business growth.

Benefits of Engaging Top Audit Firms

Engaging a top audit firm in Oman offers numerous benefits:

- Regulatory Compliance: Audits ensure compliance with CMA, Income Tax Law, and VAT regulations, avoiding fines or legal penalties.

- Financial Transparency: Detailed audit reports provide accurate financial statements, boosting trust among investors, banks, and stakeholders.

- Risk Identification: Audits detect fraud, operational inefficiencies, and financial discrepancies, enabling proactive risk management.

- Cost Optimization: Recommendations from audits streamline processes, reduce wasteful spending, and improve resource allocation.

- Enhanced Decision-Making: Comprehensive financial insights support strategic planning, budgeting, and forecasting.

- Investor Confidence: Credible audit reports attract external capital and mutually beneficial partnerships.

- License Renewal: Audited financials are often required for trade license renewals in Oman, ensuring business continuity.

Profits Driven by Audit Firms

Top audit firms contribute to profitability in the following ways:

- Tax Savings: Tax audits conducted accurately help businesses decrease their liabilities because they properly implement tax deductions and maintain adherence to Oman’s specified tax requirements such as not being taxed on profits under OMR 100,000.

- Operational Efficiency: Examining operations via audits helps companies find their operational barriers which creates leaner processes that decrease expenses while improving efficiency..

- Revenue Growth: The improvement of financial credibility increases both investor and client attraction which brings in more revenue streams..

- Penalty Avoidance: The adherence to regulations prevents organizations from paying substantial fines that would otherwise reduce their profits..

- Strategic Insights: Security audits help businesses create better financial plans which delivers sustainable profitability..

For example, XACT Auditing notes that audits help businesses save costs by identifying gaps in accounting systems, potentially increasing profits through better resource use.

Why Choose Xact Auditing?

While Xact Auditing is headquartered in Dubai, UAE, its reputation as a leading audit firm extends to clients across the GCC, including Oman, due to its high-quality services and innovative approach. Here’s why Xact Auditing is a compelling choice for businesses in Oman:

1. Expertise in GCC Regulations

The chartered accounting experts at Xact have complete knowledge of GCC financial regulations together with both Oman’s Income Tax Law and VAT framework requirements. Their extensive experience guarantees that clients can meet all requirements from the Capital Market Authority together with Omani authorities.

2. Comprehensive Audit Services

The auditing solutions at Xact include financial audits as well as internal and tax assessments and stock checks and liquidation processes that adapt to diverse enterprise types from small to large businesses. The company uses audit standards from ISA and IFRS which boosts financial credibility for their clients..

3. Client-Centric Approach

At Xact they emphasize premium professional services because they create unique solutions by using clear communication channels. Basing their delivery on promptness allows clients to develop ongoing faith in the company..

4. Innovative Technology

Xact implements powerful audit tools alongside cloud-based accounting tools which allow businesses to obtain instant financial data while producing efficient reports for tech-driven organizations in Oman..

5. Cost-Effective Solutions

High-quality audits from Xact become accessible to SMEs because the company maintains competitive pricing structures which lower costs without affecting precision. The company provides optimized expense management through its bookkeeping operations as well as its tax services..

6. Proven Track Record

Trusted by high-standing GCC clients and UAE organizations Xact delivers audit reports that both financial institutions and regulatory agencies including the UAE’s Federal Tax Authority (FTA) accept for establishing reliability in Oman.

7. Industry-Specific Expertise

Xact provides customized audit solutions through its staff which brings experience from real estate, manufacturing and hospitality sectors to help Omani businesses identify business-specific challenges..

8. VAT and Tax Consultancy

Xact provides exceptional support for Omani businesses through VAT registration and return filing services and corporate tax compliance for effective handling of the 5% VAT and 10% corporate tax requirements.

The GCC-wide operations network and remote functionality of Xact positions the company as a suitable audit service provider for Omani companies regardless of its physical location outside of the country.

FAQs: Audit Firms in Oman

Q1: Are audits mandatory for all businesses in Oman?

Audits become mandatory for SAOG listed companies as well as free zone entities and financial institutions according to requirements established by the CMA. All organizations should perform audits as they maintain compliance while ensuring transparency even if these audits strictly apply only to licensing renewals from banks.

Q2: What types of audits do top firms in Oman offer?

Companies at the top auditing level deliver customized audits that encompass financial audits, internal audits, tax audits, stock audits, risk management audits and liquidation audits.

Q3: How do audit firms improve profitability?

Financial audit assessments discover operational shortcomings which results in tax savings and better financial strategies that produce cost reductions and profit expansion.

Q4: Why choose Xact Auditing over local Omani firms?

Xact delivers uniform expertise throughout the Gulf Cooperation Council region alongside modern technology platforms and budget-friendly audit services to multiple industries where it maintains proven success. The business extends its remote features to deliver uninterrupted assistance to all Omani clients..

Q5: How often should a business conduct an audit?

Businesses running high-volume transactions need audit assessments beyond yearly inspections to track their performance.

Q6: What is the cost of audit services in Oman?

The payment amounts for financial audit services depend on both the auditing company and the size of the audited firm where Small and Medium Enterprises need to pay less than listed companies. Xact Auditing stands out with its affordable high-quality services that are cheaper than what Big Four firms provide.

Q7: How do audits support compliance with Oman’s tax laws?

Audits help businesses file their VAT at 5% and corporate tax with 10% rate that applies to profits exceeding OMR 100,000 which helps avoid penalties under the Income Tax Law.

The combination of qualified experts and inclusive services and innovative technology enables these firms to provide transparency solutions and risk control in addition to cost reduction that boosts profitability. Xact Auditing provides exceptional services to Omani businesses because its operational base is in Dubai but its practice includes GCC specifications and modern methods and personalized customer