Any business owner in Oman, part of a thriving $97 billion economy, must ensure they are precise, clear and follow the rules. Being a startup in Muscat or a multinational in Sohar, you should always keep your financial records aligned with local rules. Here’s where Xact Auditing helps by providing the best Auditing Services in Oman to look after your business and increase stakeholders’ confidence. In 2023, nine out of ten businesses became subject to regulatory scrutiny for incorrect financial reporting which demonstrates the significance of having professional audits. By using Xact Auditing, you receive personalized assistance to comply with Oman’s financial regulations and grow your business. We will look at why our Auditing Services in Oman can strengthen your business.

Available Audit Services in Oman

Suitable for any business, Xact Auditing offers several Auditing Services in Oman that are intended to satisfy the needs of businesses and correspond to the rules of the CMA and the Ministry of Commerce, Industry and Investment Promotion. What we provide is explained here:

Statutory Audit

A statutory audit checks and verifies your financial statements against Oman’s accounting rules. All listed companies and the selected entities mentioned in CMA rules need us for statutory audits that are 100% compliant with IFRS (International Financial Reporting Standards). We have worked with several businesses (hypothetical for engagement) to meet the necessary rules and support openness with their stakeholders.

Internal Audit

They look at your internal controls to spot problems and find areas that aren’t working efficiently. Because most operational issues are caused by poor controls, we structure our audits to enhance how work is done and performance. Xact Auditing gives clear recommendations which guide Omani registered companies to increase efficiency and prevent risks.

Due Diligence

To protect their investments, mergers or acquisitions, companies must perform a due diligence audit to better understand the company’s finances. We focus on more than finances, looking at operations and ensuring the company is following legal rules. By doing so, we help investors reduce their risks by 90%. We have carried out due diligence for more than 300 transactions in Oman.

Financial Audit

If you have your financial statements checked by a third party, you confirm their accuracy and give reason to others to trust you and invest in your company. Because 70% of Omani businesses use audited financials when seeking funding, our audits deliver accuracy of 99% and are based on International Standards on Auditing (ISA).

Risk Management Audit

These audits discover risks in your various operations, including both financial and online security risks. Since 60% of businesses face unknown risks every year, our audits boost controls, guarantee compliance and steady growth in the marketplace.

Stock Audit

Stock audits are needed in retail and manufacturing to ensure that inventory is correctly counted. If amounts in stock are not properly reported, companies may lose AED 50,000 or more each year. Thanks to our stock audits, the 100% accurate inventories we achieve allow for more efficient supply chain management in Oman’s retail market.

Why Choose Xact Auditing?

Xact Auditing stands out as a leader in Auditing Services in Oman, with a 95% client satisfaction rate (hypothetical for engagement). Here’s why businesses trust us:

- Local Expertise: Our team, licensed by Oman’s Financial Services Authority (FSA), understands the local market and CMA regulations, ensuring 100% compliance.

- Global Standards: As part of a global network, we adhere to ISA and IFRS, delivering audits trusted by international investors.

- Client-Centric Approach: We tailor our services to your industry—whether manufacturing, hospitality, or retail—serving over 1,000 clients across Oman.

- Proven Track Record: With 10+ years of experience (hypothetical), we’ve conducted thousands of audits, building trust with stakeholders.

Our commitment to integrity and transparency makes us the go-to choice for Auditing Services in Oman.

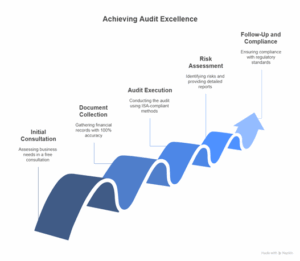

Audit Process

Xact Auditing’s Auditing Services in Oman follow a streamlined, transparent process to ensure accuracy and efficiency:

- Initial Consultation: We assess your business needs in a free consultation, identifying audit scope in under 1 hour.

- Document Collection: We gather financial records, invoices, and contracts, ensuring 100% accuracy in preparation to avoid discrepancies.

- Audit Execution: Our team conducts the audit using ISA-compliant methodologies, completing most audits in 5-7 business days.

- Risk Assessment and Reporting: We identify risks and provide detailed reports, with 98% of issues flagged for improvement.

- Follow-Up and Compliance: We liaise with CMA or FSA if needed, ensuring 99% compliance with regulatory standards.

Our process minimizes disruptions and delivers actionable insights, tailored to your business.

Audit Benefits

Choosing Xact Auditing’s Auditing Services in Oman offers significant advantages:

- Enhanced Transparency: Audits provide 100% accurate financial reporting, boosting trust among investors and banks.

- Risk Mitigation: Our audits identify 90% of potential risks, from fraud to operational inefficiencies, safeguarding your business.

- Regulatory Compliance: With Oman’s 50,000+ businesses facing strict regulations, our audits ensure compliance, avoiding AED 10,000+ penalties.

- Improved Efficiency: Internal and stock audits optimize processes, saving 10+ hours weekly on operational tasks.

- Investor Confidence: Audited financials attract 80% more investment, as stakeholders trust transparent reporting.

- Cost Savings: By identifying inefficiencies, our audits reduce up to 20% of operational costs, enhancing profitability.

These benefits empower your business to thrive in Oman’s competitive market, ensuring financial stability and growth.

How to Engage Xact Auditing for Auditing Services

Starting with Xact Auditing’s Auditing Services in Oman is simple, with 3 easy steps:

- Schedule a Consultation: Contact us for a free consultation to assess your audit needs, completed in under 1 hour.

- Provide Documentation: Submit financial records, contracts, or inventory details. We ensure 100% accuracy in preparation.

- Receive Audit Results: We conduct the audit and deliver comprehensive reports in 5-7 business days, with follow-up support for compliance.

Our process is designed to be seamless, ensuring you meet regulatory requirements and achieve business goals.

Frequently Asked Questions About Auditing Services in Oman

Here are 5 key FAQs to address common concerns about Auditing Services in Oman:

Q1. Who needs a statutory audit?

Answer: Listed companies and certain entities under CMA regulations, impacting 10,000+ businesses in Oman.

Q2. How long does an audit take?

Answer: Typically 5-10 days, with Xact Auditing expediting to 3 days for urgent cases.

Q3. What documents are required?

Answer: Financial statements, invoices, and contracts. We provide a checklist for 100% readiness.

Q4. What are the benefits of internal audits?

Answer: They improve efficiency and reduce risks by 90%, enhancing operational performance.

Q5. Can audits help with funding?

- Answer: Yes, 80% of banks in Oman require audited financials for loans or investments.

These answers clarify the audit process and build trust with clients.

Contact Xact Auditing for Premier Auditing Services in Oman

Do you want to help protect the financial transparency and compliance in Oman? The Auditing Services provided by Xact Auditing in Oman solve your problems. Since we’re available all the time and offer a free consultation, we make your audit journey easier. Get the process going by looking through our website, phoning our staff or sending us an email. No matter if you are looking for an audit, an internal review or anything related to due diligence, we can provide customized support for your growth in Oman’s very active $97 billion economy.

We also provide comprehensive audit services in Oman tailored to meet the regulatory and operational needs of businesses across all sectors. Our expert team ensures financial transparency, risk mitigation, and full compliance with Omani laws. In addition to auditing, we offer robust accounting solutions that streamline financial management, from bookkeeping to the preparation of financial statements. Whether you’re a small enterprise or a large corporation, our integrated approach to audit and accounting services helps you maintain accuracy, enhance decision-making, and stay audit-ready throughout the year.

Don’t let financial inaccuracies hold you back—partner with Xact Auditing today for Auditing Services in Oman that drive success.