Accounting in Oman is the systematic process of recording, measuring, analyzing, and reporting a business’s financial transactions to reflect its financial health within the Sultanate’s regulatory framework. Governed by the International Financial Reporting Standards (IFRS) and Oman’s tax laws—such as Value-Added Tax (VAT) at 5% (introduced April 2021) and corporate tax (15% standard, 3% for SMEs)—accounting ensures compliance with the Oman Tax Authority (OTA) while supporting business decisions.

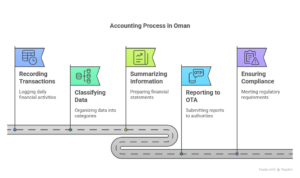

- Core Functions:

- Recording: Logging daily transactions, like OMR 1,000 in sales in Muscat.

- Classifying: Organizing data into revenue or expense categories.

- Summarizing: Preparing financial statements for Oman’s regulatory needs.

- Reporting: Submitting reports to the OTA or stakeholders.

- Types: Financial accounting for external reporting, managerial accounting for internal planning, tax accounting for Oman’s VAT and corporate tax, and cost accounting for production analysis.

Example: An Omani retailer records OMR 50,000 in sales, OMR 20,000 in costs, and OMR 2,500 in VAT, using accounting to compute a OMR 27,500 taxable profit for OTA filings.

In Oman, accounting is critical for meeting VAT quarterly deadlines (30 days post-period) and corporate tax annual filings (four months post-year-end), ensuring transparency and legal adherence.

Accounting Services for Every Business in Oman

Accounting services in Oman provide professional support tailored to businesses of all sizes—startups, SMEs, and large corporations—ensuring financial accuracy and compliance with Oman’s tax regulations. With VAT and corporate tax mandatory across sectors like retail, manufacturing, and oil and gas, these services are indispensable.

Universal Offerings in Oman:

- Bookkeeping: Daily tracking of OMR 10,000 in supplier payments.

- Financial Reporting: Preparing IFRS-compliant statements for OTA audits.

- Tax Compliance: Handling Oman’s VAT (quarterly) and corporate tax (annual).

- Payroll: Managing salaries for a 50-employee Omani firm.

Business-Specific Needs in Oman:

- Startups: Affordable bookkeeping and VAT registration for OMR 19,250 turnover businesses in Oman.

- SMEs: Tax planning to secure Oman’s 3% corporate tax rate (e.g., OMR 150,000 income cap).

- Large Firms: Complex audits for an Omani petroleum company with OMR 10 million revenue.

Example: A Salalah-based exporter in Oman uses accounting services to track zero-rated sales (OMR 200,000), reclaim OMR 10,000 in VAT, and file a 15% corporate tax return on OMR 50,000 profit.

These services adapt to Oman’s diverse business landscape, ensuring compliance with OTA rules, cost optimization, and strategic insights for every entity.

Scope of Accounting Services in Oman

The scope of accounting services in Oman defines the extensive range of tasks professionals undertake to manage finances, ensure compliance with Oman’s tax laws, and support business growth. Shaped by Oman’s VAT system, corporate tax regulations, and IFRS requirements, this scope addresses operational, regulatory, and strategic demands.

Key Areas in Oman:

- Transaction Recording: Logging daily sales and expenses across Oman’s markets.

- Tax Management: VAT registration, filing (e.g., OMR 5,000 output tax), and corporate tax computation (15% on OMR 100,000 profit = OMR 15,000) for OTA.

- Auditing: Preparing for OTA audits with five-year record retention (15 for real estate in Oman).

- Financial Analysis: Evaluating Omani businesses’ profitability (e.g., OMR 30,000 net profit).

- Advisory: Guiding on Oman’s VAT exemptions or SME tax relief.

- Payroll and Reconciliation: Managing wages and bank alignments for Omani firms.

- Specialized Scope in Oman: Includes zero-rated VAT sectors (e.g., exports, oil) and high-tax industries (55% for petroleum firms in Oman).

- Example: A Duqm logistics firm in Oman hires services to record OMR 300,000 in revenue, file VAT quarterly, prepare a OMR 40,500 corporate tax return (15%), and audit its books for OTA compliance.

Oman is comprehensive, covering everything from basic bookkeeping to strategic tax planning, tailored to the Sultanate’s economic and legal environment.

Best Chartered Accountants in Oman: Xact Auditing

Xact Auditing employs some of the best chartered accountants in Oman, renowned for their qualifications, expertise, and dedication to Omani businesses. Chartered accountants (CAs) at Xact hold globally recognized credentials (e.g., CPA, ACCA), equipping them to tackle Oman’s complex financial landscape with precision.

Qualifications in Oman: Xact’s CAs are versed in IFRS, Oman’s 5% VAT system, and corporate tax laws (15%, 3%, 55% for petroleum), with practical experience across Omani industries.

Services Provided in Oman:

- Tax Expertise: Filing VAT (e.g., OMR 2,000 quarterly) and corporate tax returns (e.g., OMR 9,000 annually at 15%) with the OTA.

- Auditing: Conducting financial audits for Oman’s regulatory compliance.

- Consulting: Advising on tax optimization, like securing Oman’s 3% SME rate for a OMR 120,000 income business.

Why Best in Oman?: Their accuracy, quick response to OTA queries, and ability to manage Omani-specific cases—like zero-rated exports (OMR 50,000 sales with OMR 2,500 VAT reclaimed)—distinguish them.

Example: A Muscat manufacturer in Oman relies on Xact’s CAs to audit OMR 500,000 in transactions, file taxes, and strategize cost reductions, leveraging their deep knowledge of Oman’s rules.

Xact’s chartered accountants shine in Oman by delivering expert solutions that align with local tax and financial standards, making them a trusted choice.

Top Accounting Firm in Oman: Xact Auditing

Xact Auditing ranks as a top accounting firm in Oman, celebrated for its comprehensive services, regional expertise, and strong reputation in supporting Omani businesses. Operating prominently in Oman and the UAE, Xact provides end-to-end financial management, earning its place as a leader in the Sultanate’s accounting sector.

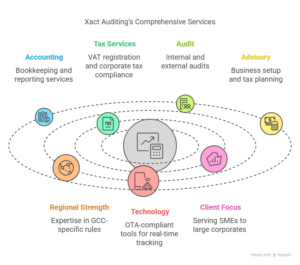

Service Breadth in Oman:

-

- Accounting: Bookkeeping and reporting (e.g., OMR 100,000 revenue statements) for Omani firms.

- Tax Services: VAT registration, filing, and corporate tax compliance with the OTA (e.g., OMR 15,000 tax on OMR 100,000 profit).

- Audit: Internal and external audits for Oman’s regulatory or investor needs.

- Advisory: Business setup, tax planning, and software solutions for Omani entities.

- Regional Strength in Oman: With experience from Oman’s VAT rollout (2021) and the UAE’s (2018), Xact excels in GCC-specific rules—like Oman’s reverse charge VAT or 55% petroleum tax.

- Technology in Oman: Offers OTA-compliant tools for real-time tracking, reducing errors for a OMR 200,000 turnover business in Oman.

- Client Focus in Oman: Serves SMEs (e.g., OMR 50,000 income firms) to large corporates, with affordable pricing tailored to Oman’s market.

- Example: An Oman-based exporter uses Xact to manage OMR 1 million in zero-rated sales, reclaim OMR 50,000 in VAT, file a OMR 135,000 corporate tax return (15%), and audit its books—all seamlessly handled.

Xact’s top status in Oman reflects its versatility, deep understanding of Omani regulations, and commitment to client success, making it a premier accounting partner.

Why choose Xact Auditing Oman for your Accounting needs?

Accounting in Oman underpins financial and tax compliance, with Xact Auditing delivering tailored services for every Omani business, a broad scope meeting local needs, and top-tier chartered accountants and firm capabilities. From managing Oman’s 5% VAT to optimizing corporate tax (15%, 3%, or 55%), Xact ensures accuracy and value—whether for a Muscat startup or a Sohar petroleum giant. Their expertise and technology make them a standout in Oman’s accounting scene. Want more details on Xact’s Oman-specific services or your business needs? Let me know!